Summary

Foundation Models (FMs) have improved time series forecasting in various sectors, such as finance, but their vulnerability to input disturbances can hinder their adoption by stakeholders, such as investors and analysts. To address this, we propose a causally grounded rating framework to study the robustness of Foundational Models for Time Series (FMTS) with respect to input perturbations. We evaluate our approach to the stock price prediction problem, a well-studied problem with easily accessible public data, evaluating six state-of-the-art (some multi-modal) FMTS across six prominent stocks spanning three industries. The ratings proposed by our framework effectively assess the robustness of FMTS and also offer actionable insights for model selection and deployment. Within the scope of our study, we find that (1) multi-modal FMTS exhibit better robustness and accuracy compared to their uni-modal versions and, (2) FMTS pre-trained on time series forecasting task exhibit better robustness and forecasting accuracy compared to general-purpose FMTS pre-trained across diverse settings. Further, to validate our framework's usability, we conduct a user study showcasing FMTS prediction errors along with our computed ratings. The study confirmed that our ratings reduced the difficulty for users in comparing the robustness of different systems.

AI Key Findings

Generated Jun 11, 2025

Methodology

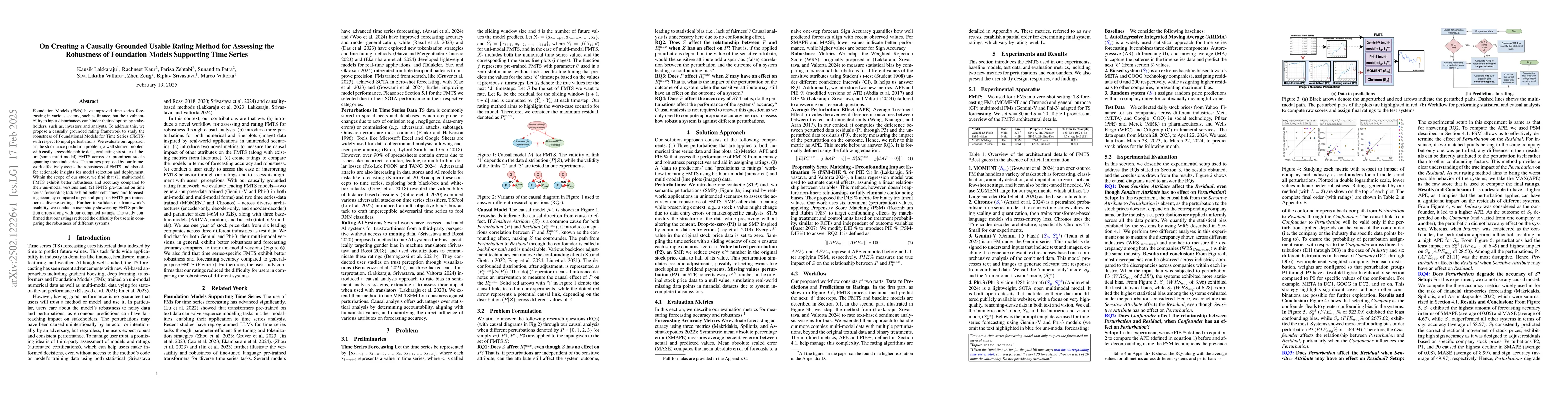

The research proposes a causally grounded rating framework to assess the robustness of Foundation Models for Time Series (FMTS) against input perturbations, focusing on stock price prediction problems. It evaluates six state-of-the-art FMTS across various stocks from three industries, comparing multi-modal and uni-modal models, as well as FMTS pre-trained on time series forecasting versus general-purpose ones.

Key Results

- Multi-modal FMTS exhibit better robustness and accuracy compared to their uni-modal counterparts.

- FMTS pre-trained on time series forecasting tasks show better robustness and forecasting accuracy than general-purpose FMTS.

- The proposed rating framework effectively assesses FMTS robustness and offers actionable insights for model selection and deployment.

- User study confirms that the computed ratings reduce the difficulty for users in comparing the robustness of different systems.

Significance

This research is significant as it addresses the vulnerability of Foundation Models in time series forecasting, a critical area for sectors like finance. By providing a causally grounded, usable rating method, it enhances the trust and adoption of FMTS by stakeholders.

Technical Contribution

The paper introduces a novel causally grounded rating framework for assessing the robustness of FMTS, along with specific evaluation metrics tailored to time series forecasting tasks.

Novelty

The research distinguishes itself by focusing on causal grounding and usability in the robustness assessment of FMTS, providing a comprehensive method that combines statistical analysis with actionable insights for model selection.

Limitations

- The study is limited to stock price prediction problems and may not generalize to other time series forecasting tasks without further validation.

- The user study, while validating the usability of the rating method, is limited in scope to a specific set of participants and may not represent broader user experiences.

Future Work

- Explore the applicability of the proposed framework and metrics to other time series forecasting problems beyond stock prices.

- Conduct larger-scale user studies to assess the usability and effectiveness of the rating method across diverse user groups.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRating Multi-Modal Time-Series Forecasting Models (MM-TSFM) for Robustness Through a Causal Lens

Biplav Srivastava, Rachneet Kaur, Zhen Zeng et al.

Decoding Latent Spaces: Assessing the Interpretability of Time Series Foundation Models for Visual Analytics

Victor Rodriguez-Fernandez, David Camacho, Javier Huertas-Tato et al.

Evaluating Time Series Foundation Models on Noisy Periodic Time Series

Syamantak Datta Gupta

No citations found for this paper.

Comments (0)