Summary

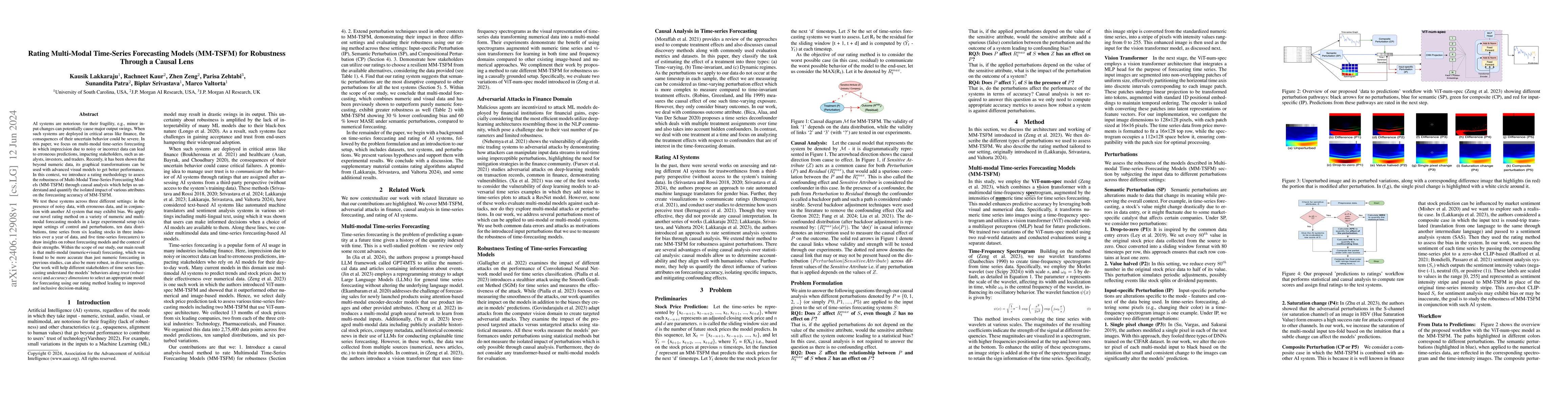

AI systems are notorious for their fragility; minor input changes can potentially cause major output swings. When such systems are deployed in critical areas like finance, the consequences of their uncertain behavior could be severe. In this paper, we focus on multi-modal time-series forecasting, where imprecision due to noisy or incorrect data can lead to erroneous predictions, impacting stakeholders such as analysts, investors, and traders. Recently, it has been shown that beyond numeric data, graphical transformations can be used with advanced visual models to achieve better performance. In this context, we introduce a rating methodology to assess the robustness of Multi-Modal Time-Series Forecasting Models (MM-TSFM) through causal analysis, which helps us understand and quantify the isolated impact of various attributes on the forecasting accuracy of MM-TSFM. We apply our novel rating method on a variety of numeric and multi-modal forecasting models in a large experimental setup (six input settings of control and perturbations, ten data distributions, time series from six leading stocks in three industries over a year of data, and five time-series forecasters) to draw insights on robust forecasting models and the context of their strengths. Within the scope of our study, our main result is that multi-modal (numeric + visual) forecasting, which was found to be more accurate than numeric forecasting in previous studies, can also be more robust in diverse settings. Our work will help different stakeholders of time-series forecasting understand the models` behaviors along trust (robustness) and accuracy dimensions to select an appropriate model for forecasting using our rating method, leading to improved decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Creating a Causally Grounded Usable Rating Method for Assessing the Robustness of Foundation Models Supporting Time Series

Biplav Srivastava, Rachneet Kaur, Zhen Zeng et al.

Causal Time-Series Synchronization for Multi-Dimensional Forecasting

Michael Mayr, Georgios C. Chasparis, Josef Küng

Multi-Modal View Enhanced Large Vision Models for Long-Term Time Series Forecasting

Haifeng Chen, Wenchao Yu, Ziming Zhao et al.

Training and Evaluating Causal Forecasting Models for Time-Series

Mathias Lécuyer, Thomas Crasson, Yacine Nabet

No citations found for this paper.

Comments (0)