Summary

In this paper we propose the notion of dynamic deviation measure, as a dynamic time-consistent extension of the (static) notion of deviation measure. To achieve time-consistency we require that a dynamic deviation measures satisfies a generalised conditional variance formula. We show that, under a domination condition, dynamic deviation measures are characterised as the solutions to a certain class of backward SDEs. We establish for any dynamic deviation measure an integral representation, and derive a dual characterisation result in terms of additively $m$-stable dual sets. Using this notion of dynamic deviation measure we formulate a dynamic mean-deviation portfolio optimisation problem in a jump-diffusion setting and identify a subgame-perfect Nash equilibrium strategy that is linear as function of wealth by deriving and solving an associated extended HJB equation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

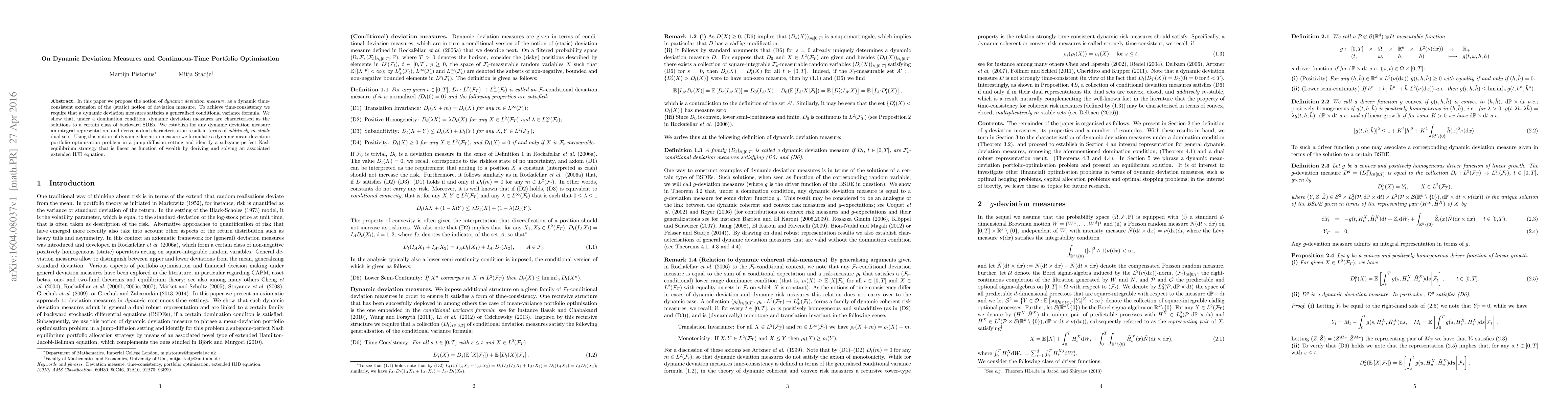

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)