Summary

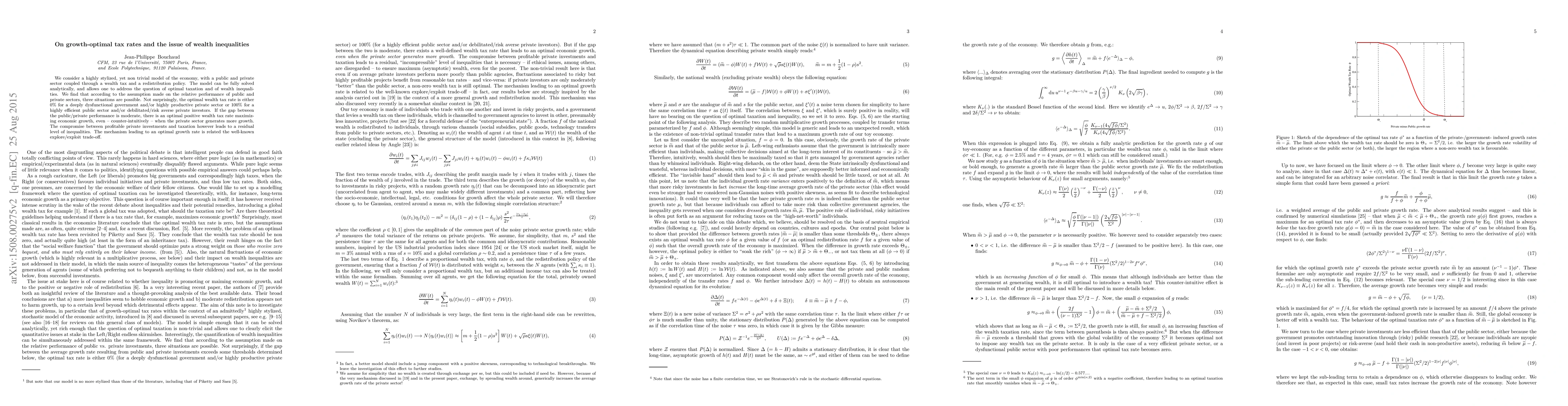

We introduce a highly stylized, yet non trivial model of the economy, with a public and private sector coupled through a wealth tax and a redistribution policy. The model can be fully solved analytically, and allows one to address the question of optimal taxation and of wealth inequalities. We find that according to the assumption made on the relative performance of public and private sectors, three situations are possible. Not surprisingly, the optimal wealth tax rate is either 0% for a deeply dysfunctional government and/or highly productive private sector, or 100 % for a highly efficient public sector and/or debilitated/risk averse private investors. If the gap between the public/private performance is moderate, there is an optimal positive wealth tax rate maximizing economic growth, even -- counter-intuitively -- when the private sector generates more growth. The compromise between profitable private investments and taxation however leads to a residual level of inequalities. The mechanism leading to an optimal growth rate is related the well-known explore/exploit trade-off.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEffectiveness of wealth-based vs exchange-based tax systems in reducing inequality

Sebastián Gonçalves, Thiago Dias

Studies on Regional Wealth Inequalities: the case of Italy

Roy Cerqueti, Marcel Ausloos

Fixed-k Tail Regression: New Evidence on Tax and Wealth Inequality from Forbes 400

Yuya Sasaki, Yulong Wang, Alexis Akira Toda et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)