Authors

Summary

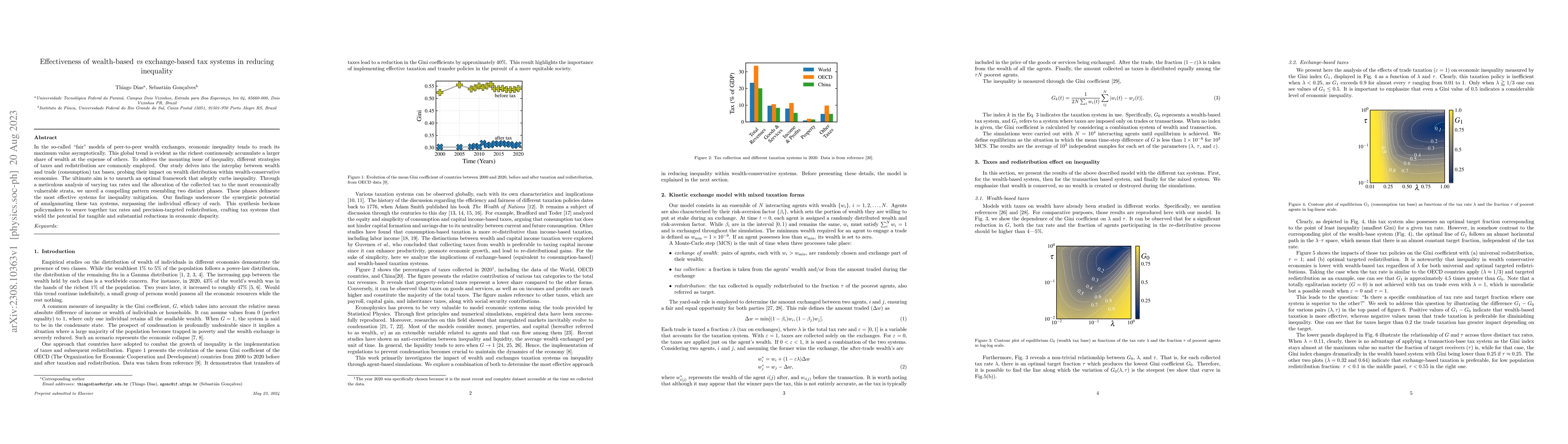

In the so-called ``fair'' models of peer-to-peer wealth exchanges, economic inequality tends to reach its maximum value asymptotically. This global trend is evident as the richest continuously accumulate a larger share of wealth at the expense of others. To address the mounting issue of inequality, different strategies of taxes and redistribution are commonly employed. Our study delves into the interplay between wealth and trade (consumption) tax bases, probing their impact on wealth distribution within wealth-conservative economies. The ultimate aim is to unearth an optimal framework that adeptly curbs inequality.Through a meticulous analysis of varying tax rates and the allocation of the collected tax to the most economically vulnerable strata, we unveil a compelling pattern resembling two distinct phases. These phases delineate the most effective systems for inequality mitigation. Our findings underscore the synergistic potential of amalgamating these tax systems, surpassing the individual efficacy of each. This synthesis beckons policymakers to weave together tax rates and precision-targeted redistribution, crafting tax systems that wield the potential for tangible and substantial reductions in economic disparity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

| Title | Authors | Year | Actions |

|---|

Comments (0)