Summary

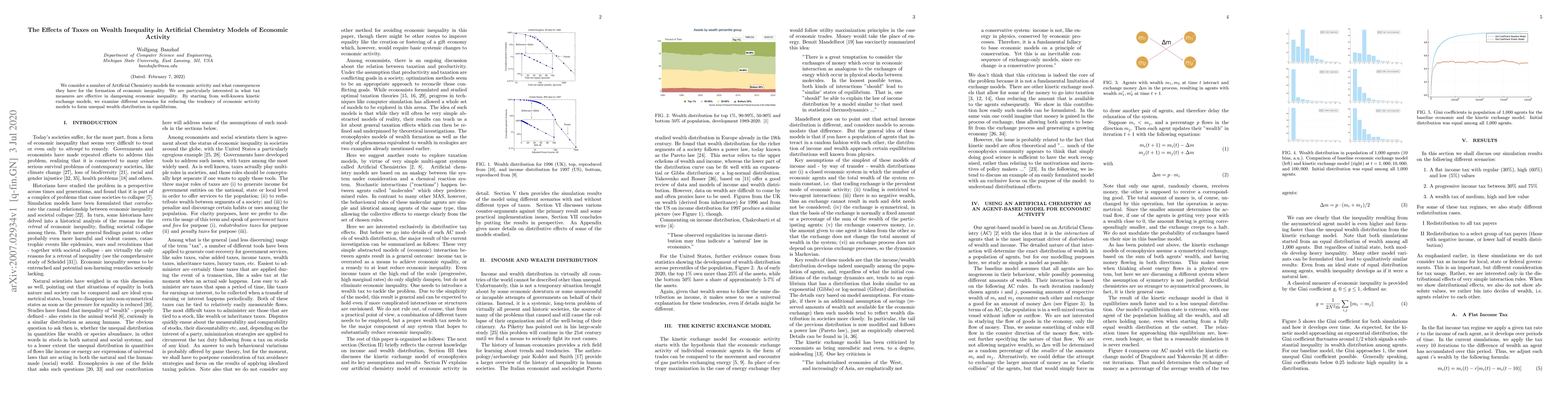

We consider a number of Artificial Chemistry models for economic activity and what consequences they have for the formation of economic inequality. We are particularly interested in what tax measures are effective in dampening economic inequality. By starting from well-known kinetic exchange models, we examine different scenarios for reducing the tendency of economic activity models to form unequal wealth distribution in equilibrium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeath, Taxes, and Inequality. Can a Minimal Model Explain Real Economic Inequality?

John C. Stevenson

Local Sharing and Sociality Effects on Wealth Inequality in a Simple Artificial Society

John C. Stevenson

Effects of taxes, redistribution actions and fiscal evasion on wealth inequality: an agent-based model approach

Iago Nascimento Barros, Marcelo Lobato Martins

| Title | Authors | Year | Actions |

|---|

Comments (0)