Summary

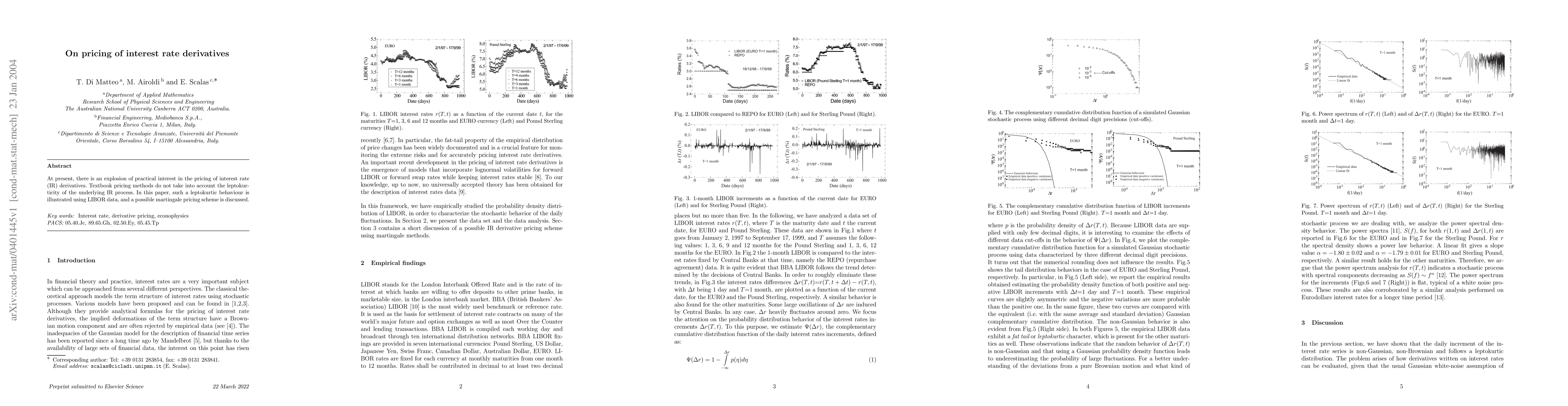

At present, there is an explosion of practical interest in the pricing of interest rate (IR) derivatives. Textbook pricing methods do not take into account the leptokurticity of the underlying IR process. In this paper, such a leptokurtic behaviour is illustrated using LIBOR data, and a possible martingale pricing scheme is discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)