Summary

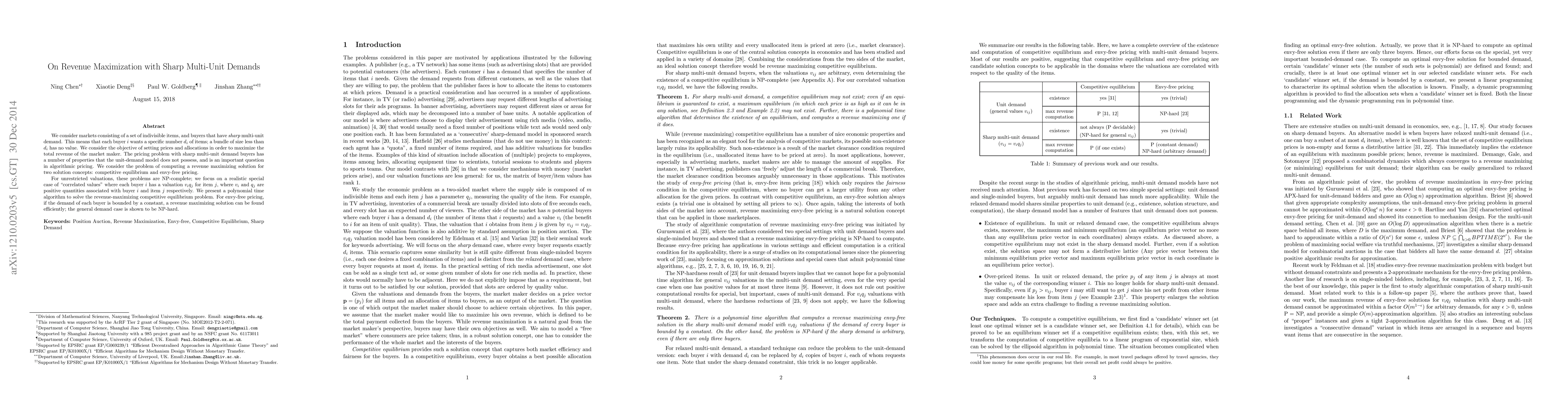

We consider markets consisting of a set of indivisible items, and buyers that have {\em sharp} multi-unit demand. This means that each buyer $i$ wants a specific number $d_i$ of items; a bundle of size less than $d_i$ has no value, while a bundle of size greater than $d_i$ is worth no more than the most valued $d_i$ items (valuations being additive). We consider the objective of setting prices and allocations in order to maximize the total revenue of the market maker. The pricing problem with sharp multi-unit demand buyers has a number of properties that the unit-demand model does not possess, and is an important question in algorithmic pricing. We consider the problem of computing a revenue maximizing solution for two solution concepts: competitive equilibrium and envy-free pricing. For unrestricted valuations, these problems are NP-complete; we focus on a realistic special case of "correlated values" where each buyer $i$ has a valuation $v_i\qual_j$ for item $j$, where $v_i$ and $\qual_j$ are positive quantities associated with buyer $i$ and item $j$ respectively. We present a polynomial time algorithm to solve the revenue-maximizing competitive equilibrium problem. For envy-free pricing, if the demand of each buyer is bounded by a constant, a revenue maximizing solution can be found efficiently; the general demand case is shown to be NP-hard.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Multi-Dimensional Online Contention Resolution Scheme for Revenue Maximization

Zhiyi Huang, Gregory Kehne, Trung Dang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)