Authors

Summary

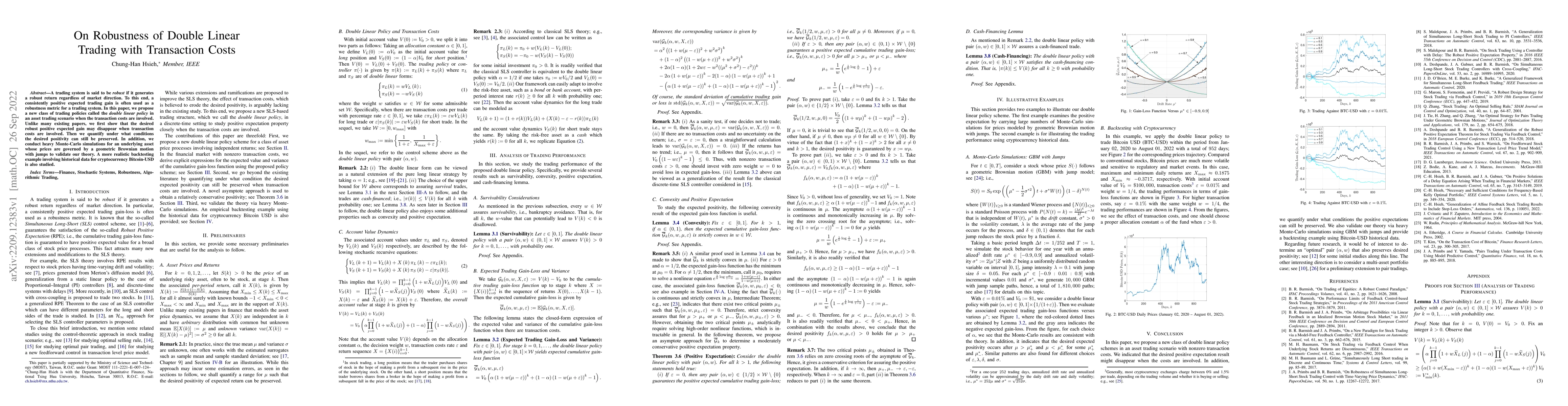

A trading system is said to be {robust} if it generates a robust return regardless of market direction. To this end, a consistently positive expected trading gain is often used as a robustness metric for a trading system. In this paper, we propose a new class of trading policies called the {double linear policy} in an asset trading scenario when the transaction costs are involved. Unlike many existing papers, we first show that the desired robust positive expected gain may disappear when transaction costs are involved. Then we quantify under what conditions the desired positivity can still be preserved. In addition, we conduct heavy Monte-Carlo simulations for an underlying asset whose prices are governed by a geometric Brownian motion with jumps to validate our theory. A more realistic backtesting example involving historical data for cryptocurrency Bitcoin-USD is also studied.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)