Summary

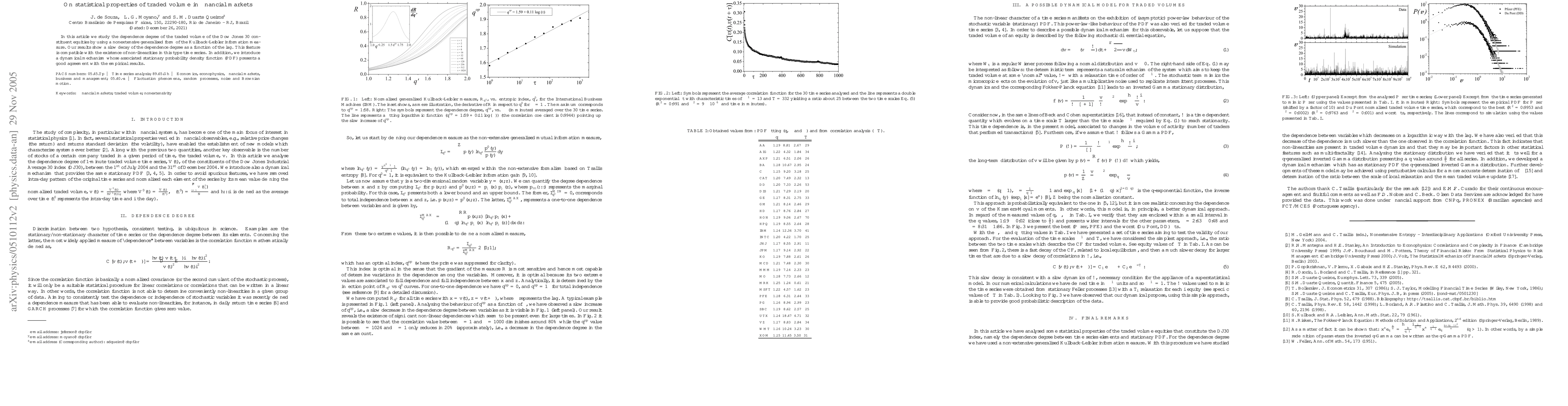

In this article we study the dependence degree of the traded volume of the Dow Jones 30 constituent equities by using a nonextensive generalised form of the Kullback-Leibler information measure. Our results show a slow decay of the dependence degree as a function of the lag. This feature is compatible with the existence of non-linearities in this type time series. In addition, we introduce a dynamical mechanism whose associated stationary probability density function (PDF) presents a good agreement with the empirical results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)