Authors

Summary

In a multi-dimensional diffusion framework, the price of a financial derivative can be expressed as an iterated conditional expectation, where the inner conditional expectation conditions on the future of an auxiliary process that enters into the dynamics for the spot. Inspired by results from non-linear filtering theory, we show that this inner conditional expectation solves a backward SPDE (a so-called 'conditional Feynman-Kac formula'), thereby establishing a connection between SPDE and derivative pricing theory. Unlike situations considered previously in the literature, the problem at hand requires conditioning on a backward filtration generated by the noise of the auxiliary process and enlarged by its terminal value, leading us to search for a backward Brownian motion in this filtration. This adds an additional source of irregularity to the associated SPDE which must be tackled with new techniques. Moreover, through the conditional Feynman-Kac formula, we establish an alternative class of so-called mixed Monte-Carlo PDE numerical methods for pricing financial derivatives. Finally, we provide a simple demonstration of this method by pricing a European put option.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

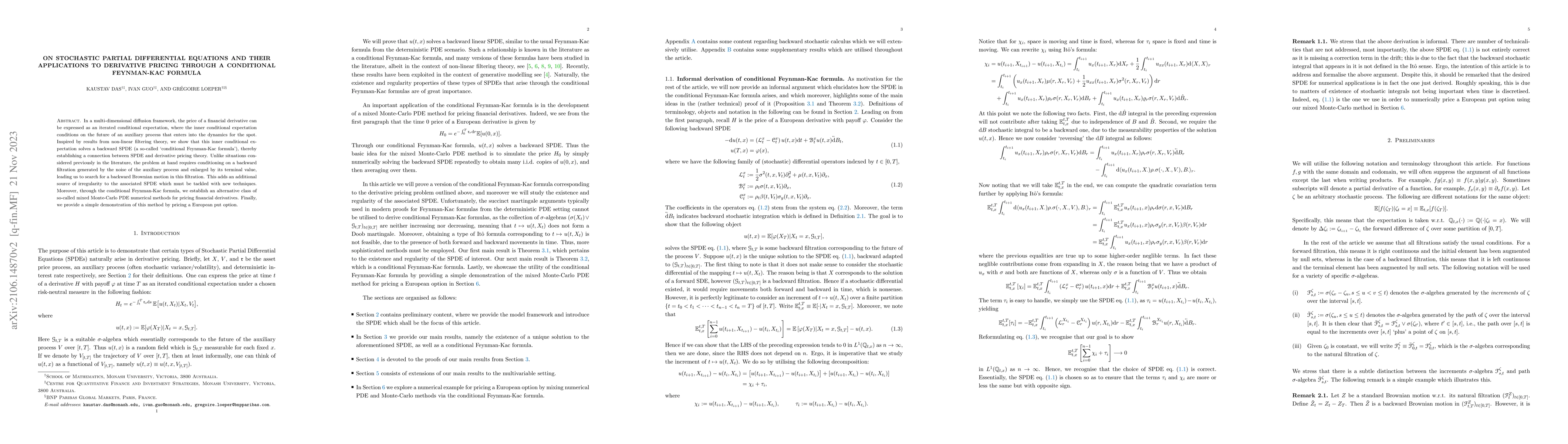

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)