Authors

Summary

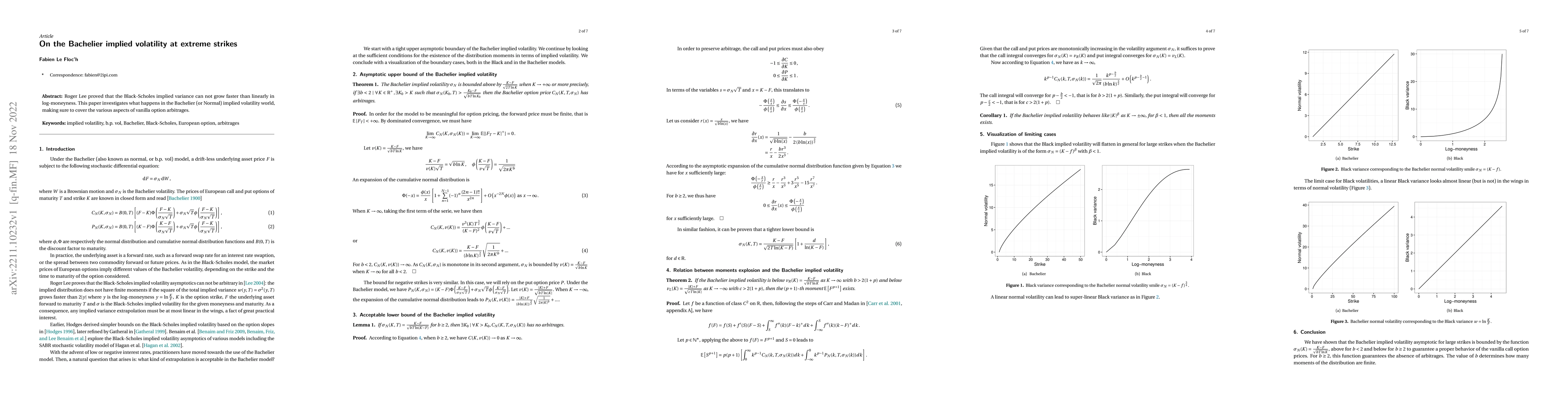

What kind of implied volatility extrapolation is appropriate? Roger Lee proved that the Black-Scholes implied variance can not grow faster than linearly in log-moneyness. This paper investigates what happens in the Bachelier (or Normal) implied volatility world, making sure to cover the various aspects of vanilla option arbitrages.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

On the implied volatility of European and Asian call options under the stochastic volatility Bachelier model

Elisa Alòs, Eulalia Nualart, Makar Pravosud

No citations found for this paper.

Comments (0)