Summary

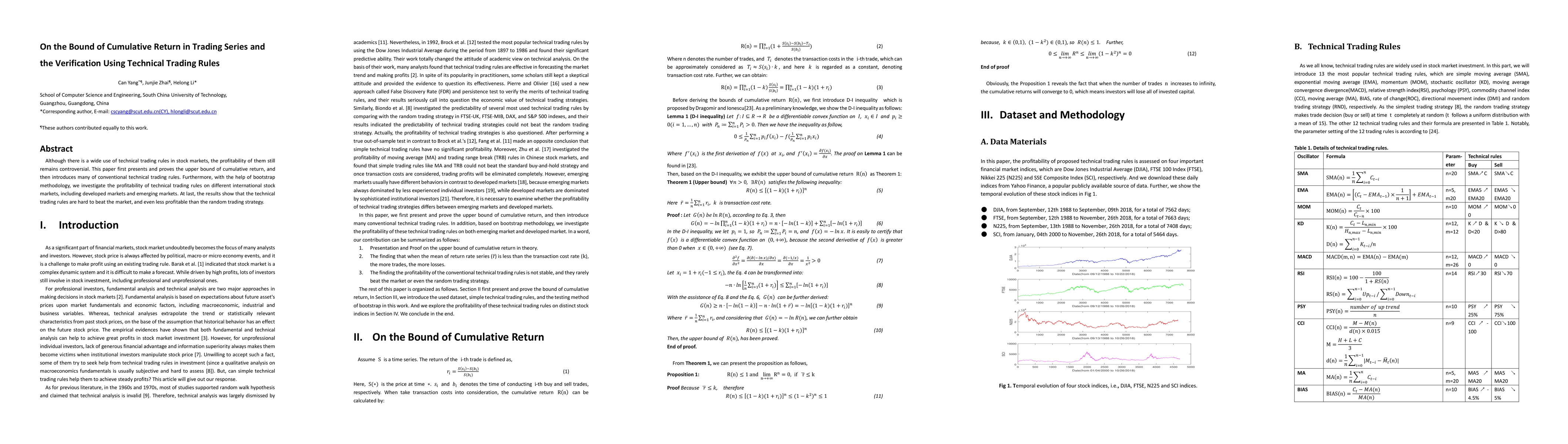

Although there is a wide use of technical trading rules in stock markets, the profitability of them still remains controversial. This paper first presents and proves the upper bound of cumulative return, and then introduces many of conventional technical trading rules. Furthermore, with the help of bootstrap methodology, we investigate the profitability of technical trading rules on different international stock markets, including developed markets and emerging markets. At last, the results show that the technical trading rules are hard to beat the market, and even less profitable than the random trading strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)