Summary

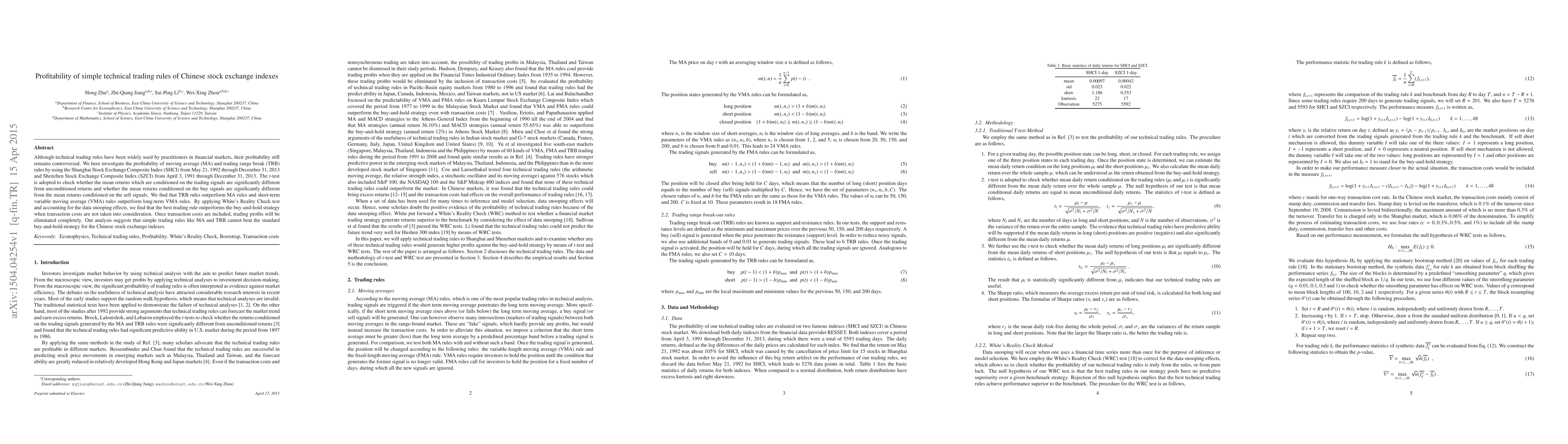

Although technical trading rules have been widely used by practitioners in financial markets, their profitability still remains controversial. We here investigate the profitability of moving average (MA) and trading range break (TRB) rules by using the Shanghai Stock Exchange Composite Index (SHCI) from May 21, 1992 through December 31, 2013 and Shenzhen Stock Exchange Composite Index (SZCI) from April 3, 1991 through December 31, 2013. The $t$-test is adopted to check whether the mean returns which are conditioned on the trading signals are significantly different from unconditioned returns and whether the mean returns conditioned on the buy signals are significantly different from the mean returns conditioned on the sell signals. We find that TRB rules outperform MA rules and short-term variable moving average (VMA) rules outperform long-term VMA rules. By applying White's Reality Check test and accounting for the data snooping effects, we find that the best trading rule outperforms the buy-and-hold strategy when transaction costs are not taken into consideration. Once transaction costs are included, trading profits will be eliminated completely. Our analysis suggests that simple trading rules like MA and TRB cannot beat the standard buy-and-hold strategy for the Chinese stock exchange indexes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)