Authors

Summary

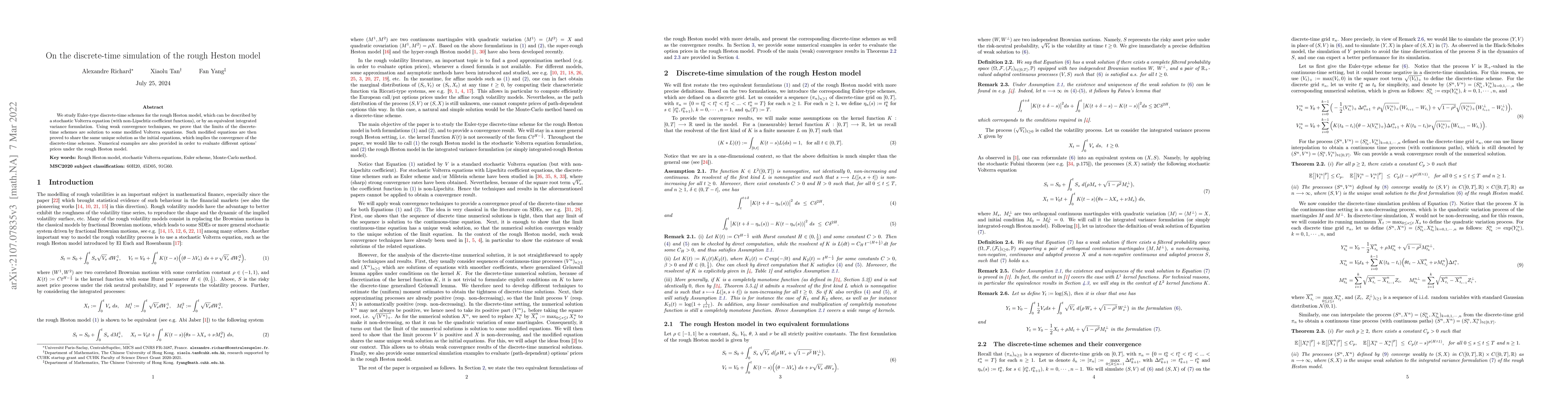

We study Euler-type discrete-time schemes for the rough Heston model, which can be described by a stochastic Volterra equation (with non-Lipschtiz coefficient functions), or by an equivalent integrated variance formulation. Using weak convergence techniques, we prove that the limits of the discrete-time schemes are solution to some modified Volterra equations. Such modified equations are then proved to share the same unique solution as the initial equations, which implies the convergence of the discrete-time schemes. Numerical examples are also provided in order to evaluate different derivative options prices under the rough Heston model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient option pricing in the rough Heston model using weak simulation schemes

Christian Bayer, Simon Breneis

The rough Hawkes Heston stochastic volatility model

Alessandro Bondi, Sergio Pulido, Simone Scotti

| Title | Authors | Year | Actions |

|---|

Comments (0)