Summary

It is well know that, in the short maturity limit, the implied volatility approaches the integral harmonic mean of the local volatility with respect to log-strike, see [Berestycki et al., Asymptotics and calibration of local volatility models, Quantitative Finance, 2, 2002]. This paper is dedicated to a complementary model-free result: an arbitrage-free implied volatility in fact is the harmonic mean of a positive function for any fixed maturity. We investigate the latter function, which is tightly linked to Fukasawa's invertible map $f_{1/2}$ [Fukasawa, The normalizing transformation of the implied volatility smile, Mathematical Finance, 22, 2012], and its relation with the local volatility surface. It turns out that the log-strike transformation $z = f_{1/2}(k)$ defines a new coordinate system in which the short-dated implied volatility approaches the arithmetic (as opposed to harmonic) mean of the local volatility. As an illustration, we consider the case of the SSVI parameterization: in this setting, we obtain an explicit formula for the volatility swap from options on realized variance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

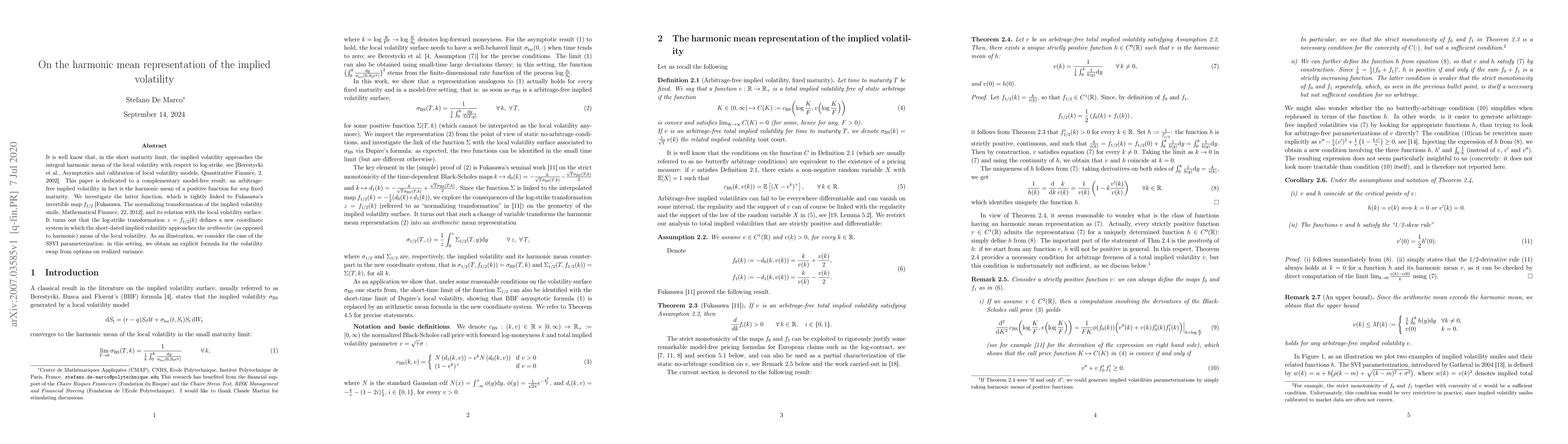

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe ATM implied volatility slope, the (dual) volatility swap, and the (dual) zero vanna implied volatility

Frido Rolloos

On the implied volatility of Asian options under stochastic volatility models

Elisa Alòs, Eulalia Nualart, Makar Pravosud

| Title | Authors | Year | Actions |

|---|

Comments (0)