Authors

Summary

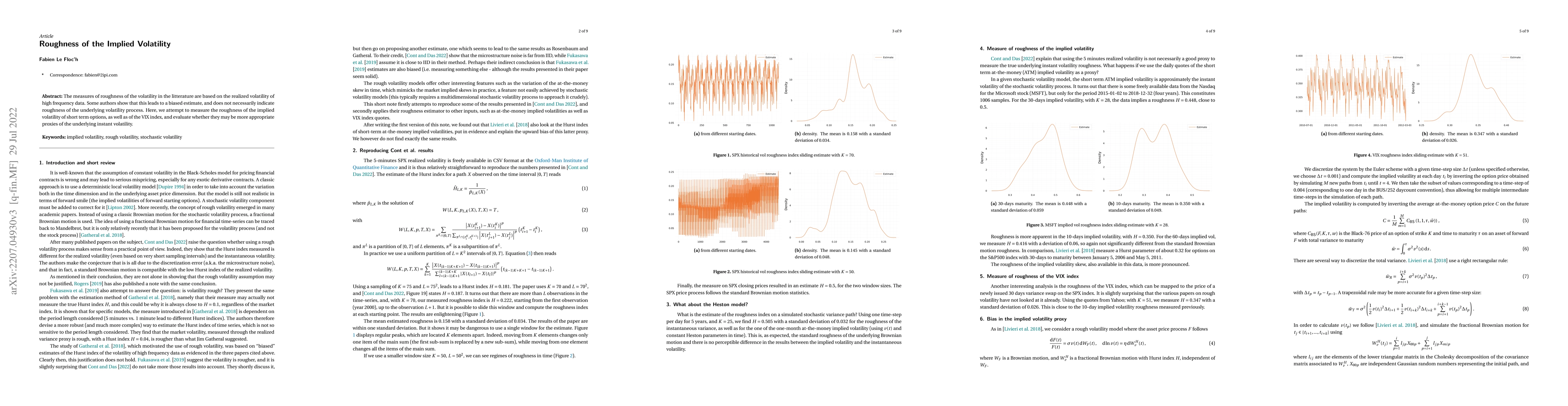

The measures of roughness of the volatility in the litterature are based on the realized volatility of high frequency data. Some authors show that this leads to a biased estimate, and does not necessarily indicate roughness of the underlying volatility process. Here, we attempt to measure the roughness of the implied volatility of short term options, as well as of the VIX index, and evaluate whether they may be more appropriate proxies of the underlying instant volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the implied volatility of Asian options under stochastic volatility models

Elisa Alòs, Eulalia Nualart, Makar Pravosud

The ATM implied volatility slope, the (dual) volatility swap, and the (dual) zero vanna implied volatility

Frido Rolloos

On the implied volatility of Inverse and Quanto Inverse options under stochastic volatility models

Elisa Alòs, Eulalia Nualart, Makar Pravosud

No citations found for this paper.

Comments (0)