Summary

This paper examines the influence of low-frequency macroeconomic variables on the high-frequency returns of copper futures and the long-term correlation with the S&P 500 index, employing GARCH-MIDAS and DCC-MIDAS modeling frameworks. The estimated results of GARCH-MIDAS show that realized volatility (RV), level of interest rates (IR), industrial production (IP) and producer price index (PPI), volatility of Slope, PPI, consumer sentiment index (CSI), and dollar index (DI) have significant impacts on Copper futures returns, among which PPI is the most efficient macroeconomic variable. From comparison among DCC-GARCH and DCC-MIDAS model, the added MIDAS filter of PPI improves the model fitness and have better performance than RV in effecting the long-run relationship between Copper futures and S&P 500.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

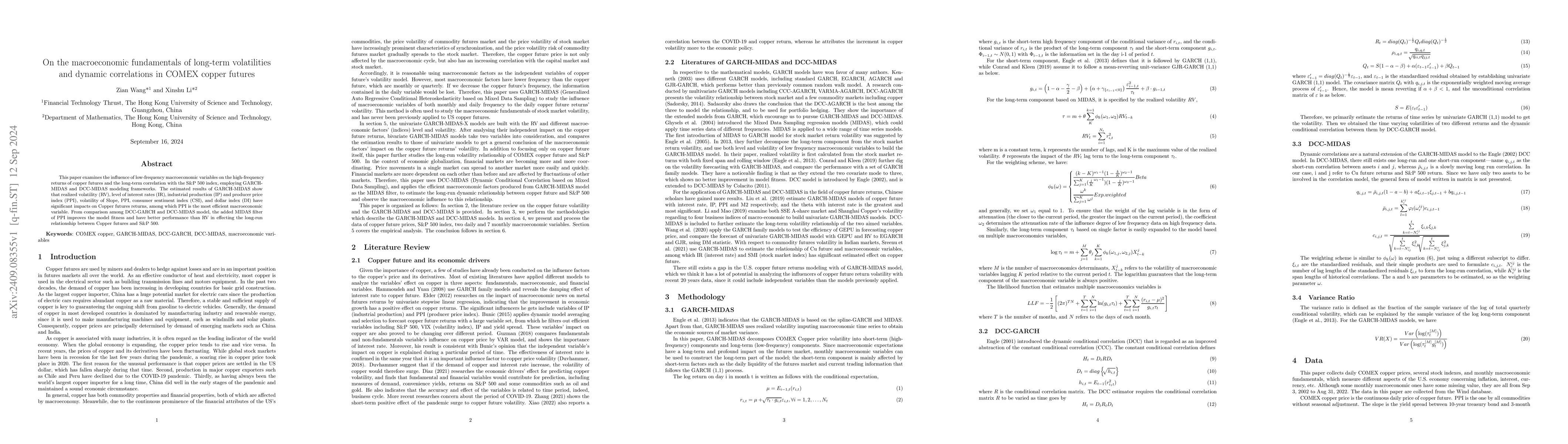

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)