Authors

Summary

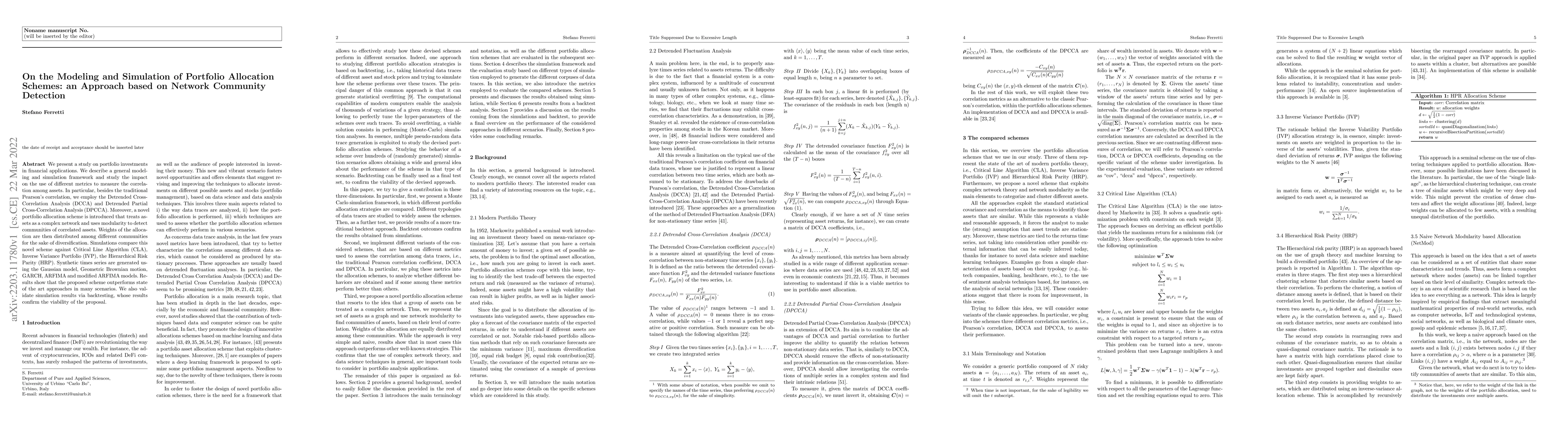

We present a study on portfolio investments in financial applications. We describe a general modeling and simulation framework and study the impact on the use of different metrics to measure the correlation among assets. In particular, besides the traditional Pearson's correlation, we employ the Detrended Cross-Correlation Analysis (DCCA) and Detrended Partial Cross-Correlation Analysis (DPCCA). Moreover, a novel portfolio allocation scheme is introduced that treats assets as a complex network and uses modularity to detect communities of correlated assets. Weights of the allocation are then distributed among different communities for the sake of diversification. Simulations compare this novel scheme against Critical Line Algorithm (CLA), Inverse Variance Portfolio (IVP), the Hierarchical Risk Parity (HRP). Synthetic times series are generated using the Gaussian model, Geometric Brownian motion, GARCH, ARFIMA and modified ARFIMA models. Results show that the proposed scheme outperforms state of the art approaches in many scenarios. We also validate simulation results via backtesting, whose results confirm the viability of the proposal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCommunity detection and portfolio optimization

Lin Chen, Chao Wang, Longfeng Zhao et al.

Onflow: an online portfolio allocation algorithm

Gabriel Turinici, Pierre Brugiere

Social Network Community Detection Based on Textual Content Similarity and Sentimental Tendency

Ang Li, Jie Gao, Yingxia Shao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)