Summary

In this paper, we model the cash surplus (or equity) of a risky business with a Brownian motion. Owners can take cash out of the surplus in the form of "dividends", subject to transaction costs. However, if the surplus hits 0 then ruin occurs and the business cannot operate any more. We consider two types of dividend distributions: (i) periodic, regular ones (that is, dividends can be paid only at countable many points in time, according to a specific arrival process); and (ii) extraordinary dividend payments that can be made immediately at any time (that is, the dividend decision time space is continuous and matches that of the surplus process). Both types of dividends attract proportional transaction costs, and extraordinary distributions also attracts fixed transaction costs, a realistic feature. A dividend strategy that involves both types of distributions (periodic and extraordinary) is qualified as "hybrid". We determine which strategies (either periodic, immediate, or hybrid) are optimal, that is, we show which are the strategies that maximise the expected present value of dividends paid until ruin, net of transaction costs. Sometimes, a liquidation strategy (which pays out all monies and stops the process) is optimal. Which strategy is optimal depends on the profitability of the business, and the level of (proportional and fixed) transaction costs. Results are illustrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

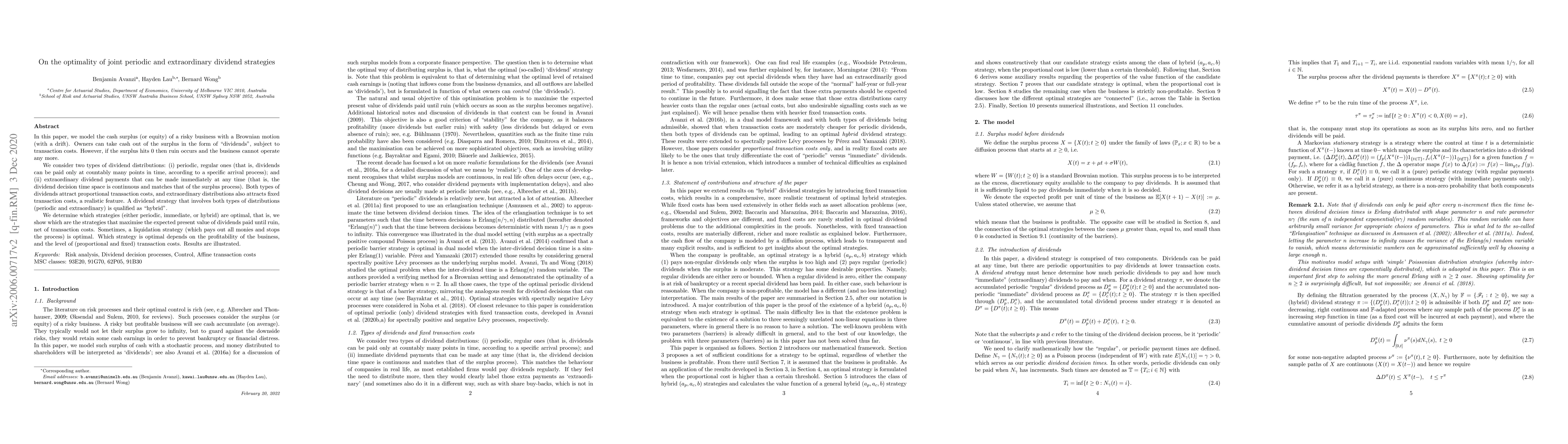

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Risk Policies and Periodic Dividend Strategies for an Insurance Company

Harold A. Moreno-Franco, Mark Kelbert, Nikolai P. Pogorelov

On optimal periodic dividend and capital injection strategies for general Lévy models

Kei Noba, Dante Mata, José-Luis Pérez

| Title | Authors | Year | Actions |

|---|

Comments (0)