Summary

We study a robust optimal stopping problem with respect to a set $\cP$ of mutually singular probabilities. This can be interpreted as a zero-sum controller-stopper game in which the stopper is trying to maximize its pay-off while an adverse player wants to minimize this payoff by choosing an evaluation criteria from $\cP$. We show that the \emph{upper Snell envelope $\ol{Z}$} of the reward process $Y$ is a supermartingale with respect to an appropriately defined nonlinear expectation $\ul{\sE}$, and $\ol{Z}$ is further an $\ul{\sE}-$martingale up to the first time $\t^*$ when $\ol{Z}$ meets $Y$. Consequently, $\t^*$ is the optimal stopping time for the robust optimal stopping problem and the corresponding zero-sum game has a value. Although the result seems similar to the one obtained in the classical optimal stopping theory, the mutual singularity of probabilities and the game aspect of the problem give rise to major technical hurdles, which we circumvent using some new methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

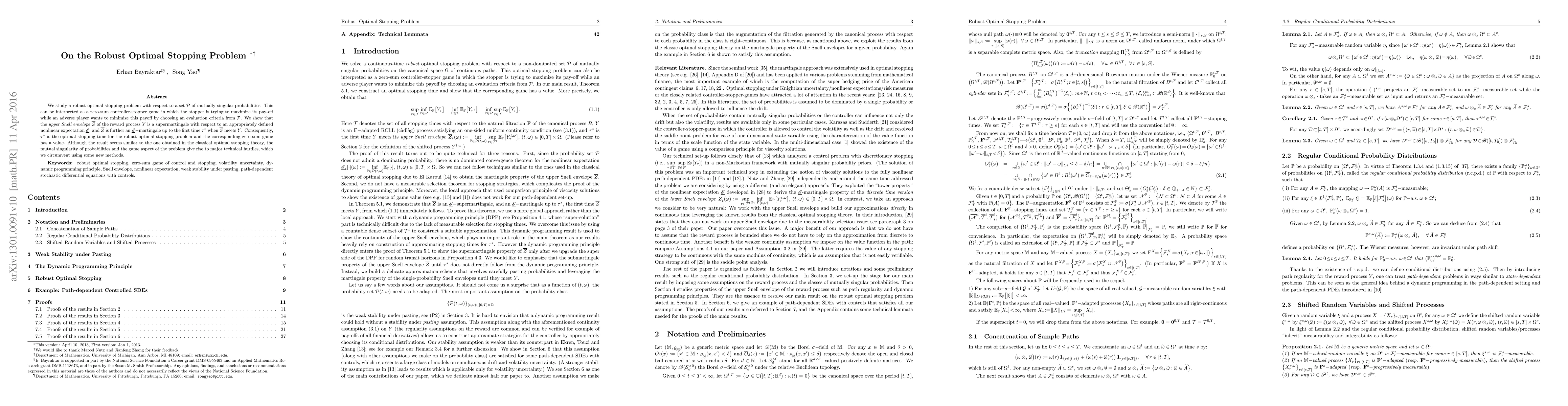

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust optimal stopping with regime switching

Xin Zhang, Zhen Wu, Jie Xiong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)