Summary

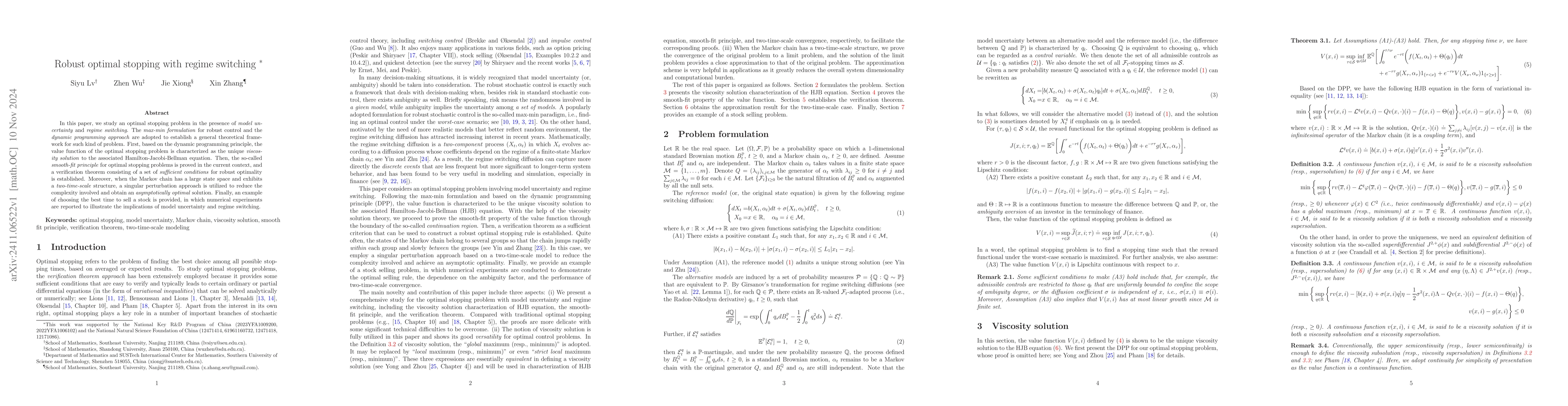

In this paper, we study an optimal stopping problem in the presence of model uncertainty and regime switching. The max-min formulation for robust control and the dynamic programming approach are adopted to establish a general theoretical framework for such kind of problem. First, based on the dynamic programming principle, the value function of the optimal stopping problem is characterized as the unique viscosity solution to the associated Hamilton-Jacobi-Bellman equation. Then, the so-called smooth-fit principle for optimal stopping problems is proved in the current context, and a verification theorem consisting of a set of sufficient conditions for robust optimality is established. Moreover, when the Markov chain has a large state space and exhibits a two-time-scale structure, a singular perturbation approach is utilized to reduce the complexity involved and obtain an asymptotically optimal solution. Finally, an example of choosing the best time to sell a stock is provided, in which numerical experiments are reported to illustrate the implications of model uncertainty and regime switching.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersConstrained optimal stopping under a regime-switching model

Takuji Arai, Masahiko Takenaka

Solving a class of zero-sum stopping game with regime switching

Xiao Yang, Siyu Lv

No citations found for this paper.

Comments (0)