Summary

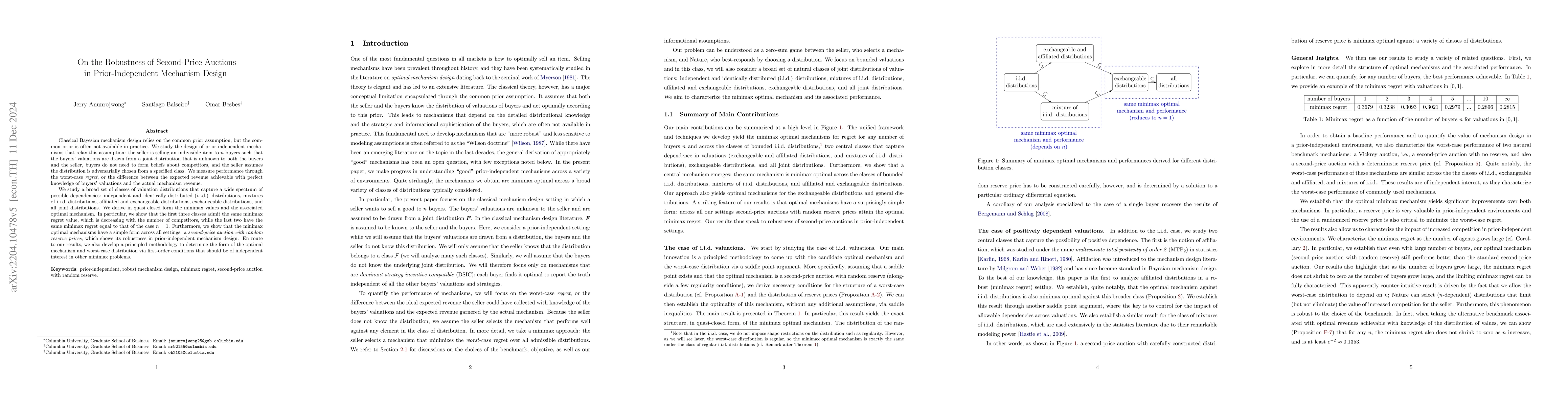

Classical Bayesian mechanism design relies on the common prior assumption, but such prior is often not available in practice. We study the design of prior-independent mechanisms that relax this assumption: the seller is selling an indivisible item to $n$ buyers such that the buyers' valuations are drawn from a joint distribution that is unknown to both the buyers and the seller; buyers do not need to form beliefs about competitors, and the seller assumes the distribution is adversarially chosen from a specified class. We measure performance through the worst-case regret, or the difference between the expected revenue achievable with perfect knowledge of buyers' valuations and the actual mechanism revenue. We study a broad set of classes of valuation distributions that capture a wide spectrum of possible dependencies: independent and identically distributed (i.i.d.) distributions, mixtures of i.i.d. distributions, affiliated and exchangeable distributions, exchangeable distributions, and all joint distributions. We derive in quasi closed form the minimax values and the associated optimal mechanism. In particular, we show that the first three classes admit the same minimax regret value, which is decreasing with the number of competitors, while the last two have the same minimax regret equal to that of the single buyer case. Furthermore, we show that the minimax optimal mechanisms have a simple form across all settings: a second-price auction with random reserve prices, which shows its robustness in prior-independent mechanism design. En route to our results, we also develop a principled methodology to determine the form of the optimal mechanism and worst-case distribution via first-order conditions that should be of independent interest in other minimax problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrior-Independent Bidding Strategies for First-Price Auctions

Rachitesh Kumar, Omar Mouchtaki

Prior-Independent Auctions for Heterogeneous Bidders

Di Wang, Aranyak Mehta, Guru Guruganesh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)