Authors

Summary

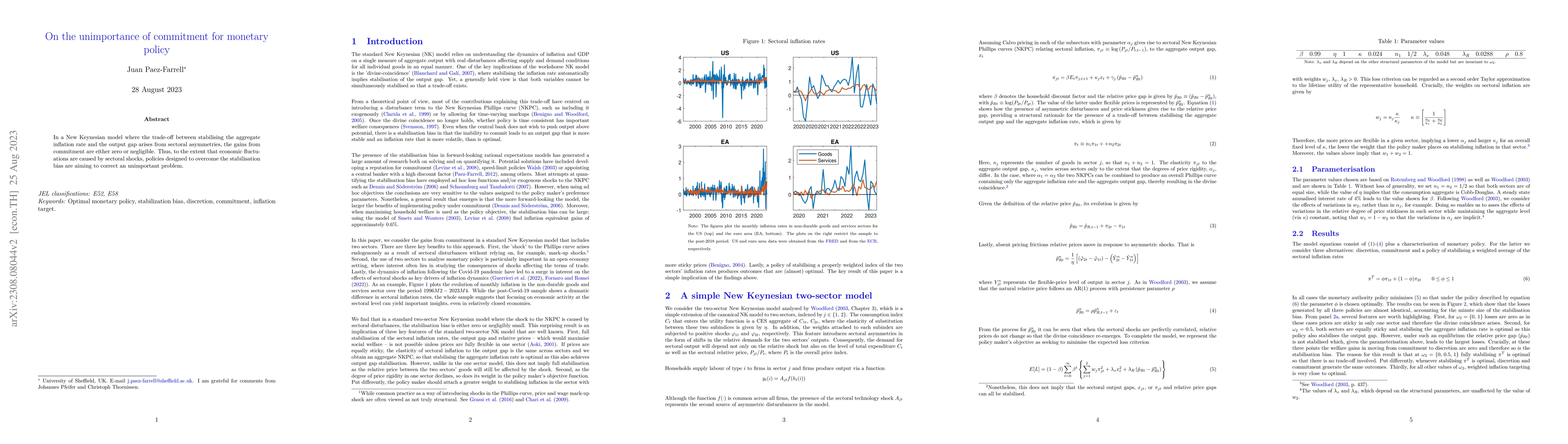

In a New Keynesian model where the trade-off between stabilising the aggregate inflation rate and the output gap arises from sectoral asymmetries, the gains from commitment are either zero or negligible. Thus, to the extent that economic fluctuations are caused by sectoral shocks, policies designed to overcome the stabilisation bias are aiming to correct an unimportant problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExamining the Effect of Monetary Policy and Monetary Policy Uncertainty on Cryptocurrencies Market

Mohammadreza Mahmoudi

Monetary policy and the racial wage gap

Ram Sewak Dubey, Eric Olson, Edmond Berisha

No citations found for this paper.

Comments (0)