Authors

Summary

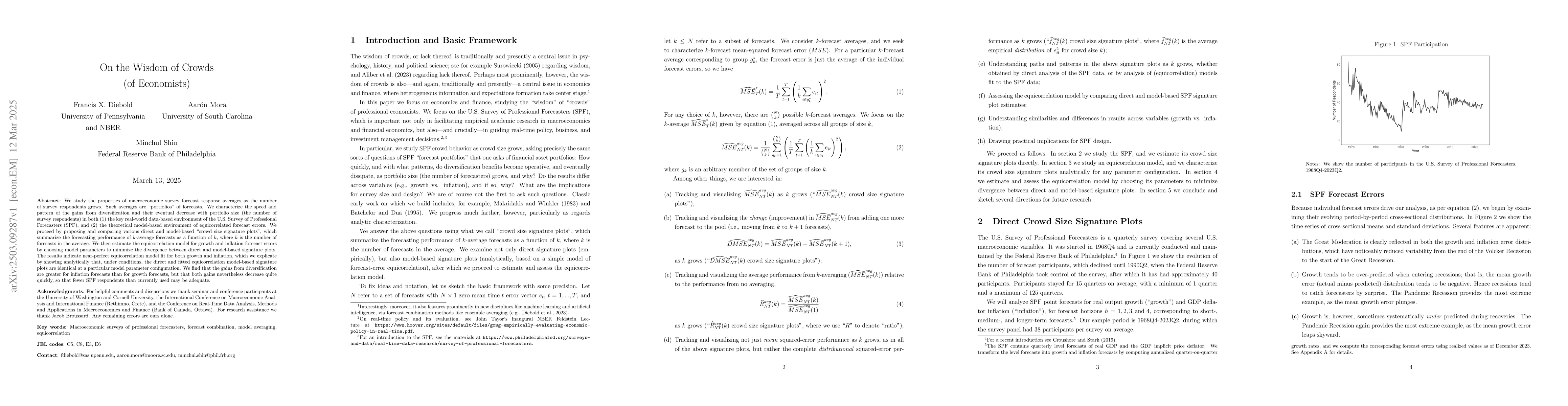

We study the properties of macroeconomic survey forecast response averages as the number of survey respondents grows. Such averages are "portfolios" of forecasts. We characterize the speed and pattern of the gains from diversification and their eventual decrease with portfolio size (the number of survey respondents) in both (1) the key real-world data-based environment of the U.S. Survey of Professional Forecasters (SPF), and (2) the theoretical model-based environment of equicorrelated forecast errors. We proceed by proposing and comparing various direct and model-based "crowd size signature plots," which summarize the forecasting performance of k-average forecasts as a function of k, where k is the number of forecasts in the average. We then estimate the equicorrelation model for growth and inflation forecast errors by choosing model parameters to minimize the divergence between direct and model-based signature plots. The results indicate near-perfect equicorrelation model fit for both growth and inflation, which we explicate by showing analytically that, under conditions, the direct and fitted equicorrelation model-based signature plots are identical at a particular model parameter configuration, which we characterize. We find that the gains from diversification are greater for inflation forecasts than for growth forecasts, but that both gains nevertheless decrease quite quickly, so that fewer SPF respondents than currently used may be adequate.

AI Key Findings

Generated Jun 10, 2025

Methodology

The study analyzes macroeconomic survey forecast response averages as the number of respondents grows, using both real-world data from the U.S. Survey of Professional Forecasters (SPF) and a theoretical model-based environment of equicorrelated forecast errors. The paper proposes and compares various 'crowd size signature plots' to summarize forecasting performance as a function of the number of forecasts in the average.

Key Results

- Gains from diversification are greater for inflation forecasts than for growth forecasts.

- Both gains decrease quite quickly, suggesting fewer SPF respondents than currently used may be adequate.

- Near-perfect equicorrelation model fit for both growth and inflation forecast errors.

- Analytical results for MSE, DMSE, and Ravg are readily obtainable under equicorrelation.

- Equicorrelation model parameters are estimated by choosing them to minimize the divergence between direct and model-based signature plots.

Significance

This research is important as it provides insights into the efficiency of crowd-sourced forecasts in macroeconomics, which can inform policy decisions and improve forecasting practices.

Technical Contribution

The paper presents analytical results for MSE, DMSE, and Ravg under equicorrelation, and develops a matching estimator for the equicorrelation model parameters by minimizing the divergence between direct and model-based signature plots.

Novelty

This work distinguishes itself by characterizing the speed and pattern of gains from diversification in macroeconomic survey forecasts using both real-world and theoretical models, and by providing a near-perfect equicorrelation model fit for growth and inflation forecast errors.

Limitations

- The study assumes overlapping information sets among economic forecasters, which may not always hold in practice.

- The equicorrelation model, while useful, is a simplification and may not capture all nuances of real-world forecast errors.

Future Work

- Explore 'best k-average' forecast MSE as a function of k, where the unique best k-average forecast is obtained each period.

- Allow for time-varying equicorrelation parameters to account for changes in forecast error characteristics over time.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)