Summary

Vector autoregressive (VAR) models are widely used in practical studies, e.g., forecasting, modelling policy transmission mechanism, and measuring connection of economic agents. To better capture the dynamics, this paper introduces a new class of time-varying VAR models in which the coefficients and covariance matrix of the error innovations are allowed to change smoothly over time. Accordingly, we establish a set of theories, including the impulse responses analyses subject to both of the short-run timing and the long-run restrictions, an information criterion to select the optimal lag, and a Wald-type test to determine the constant coefficients. Simulation studies are conducted to evaluate the theoretical findings. Finally, we demonstrate the empirical relevance and usefulness of the proposed methods through an application to the transmission mechanism of U.S. monetary policy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

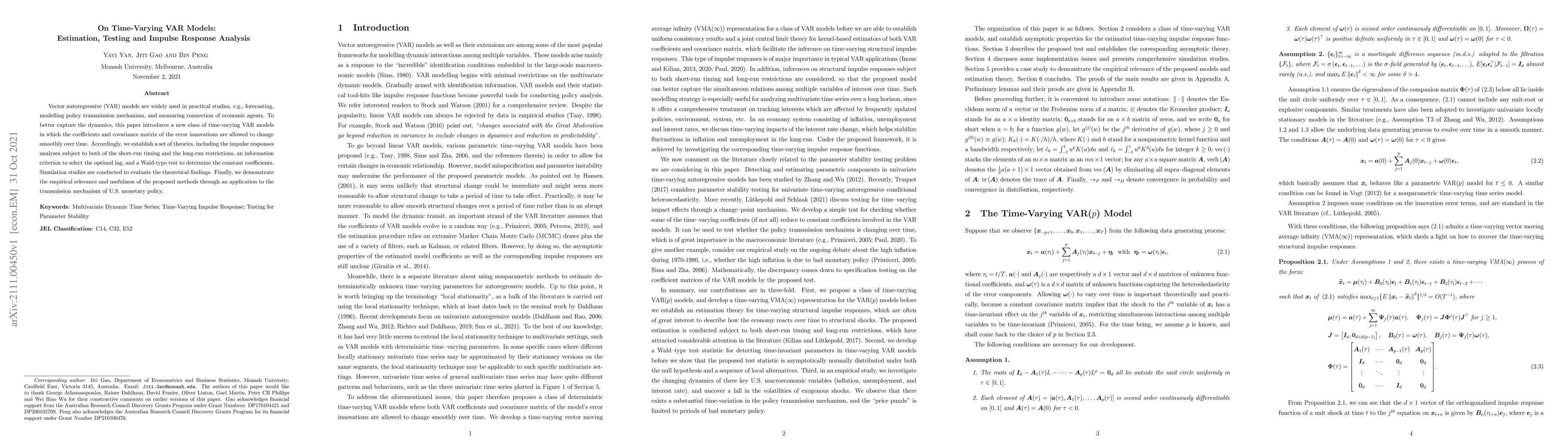

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImpulse Response Analysis of Structural Nonlinear Time Series Models

Giovanni Ballarin

| Title | Authors | Year | Actions |

|---|

Comments (0)