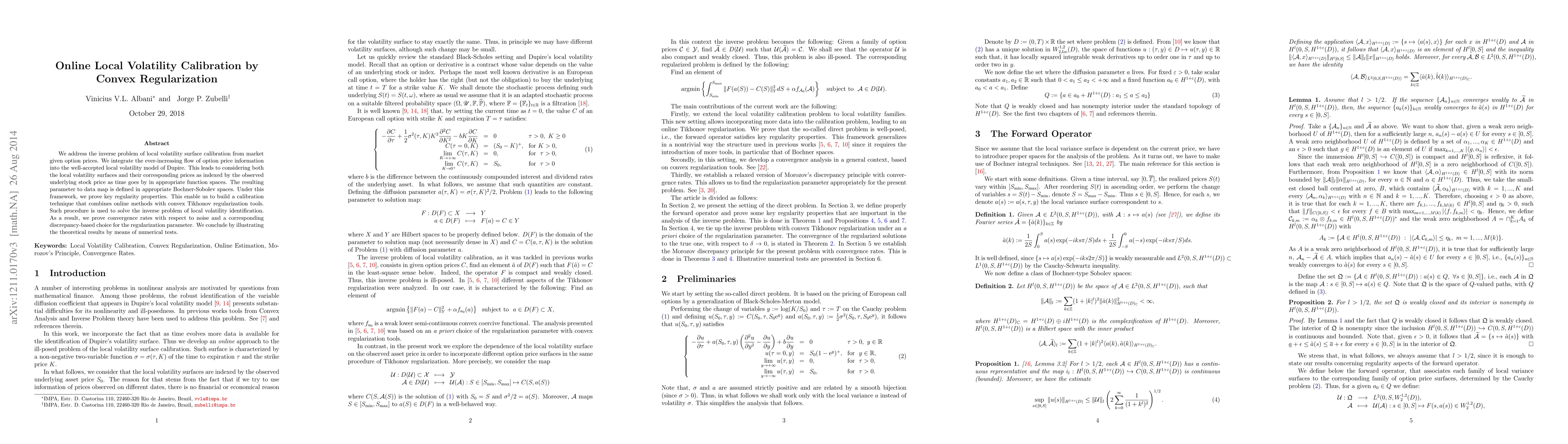

Summary

We address the inverse problem of local volatility surface calibration from market given option prices. We integrate the ever-increasing flow of option price information into the well-accepted local volatility model of Dupire. This leads to considering both the local volatility surfaces and their corresponding prices as indexed by the observed underlying stock price as time goes by in appropriate function spaces. The resulting parameter to data map is defined in appropriate Bochner-Sobolev spaces. Under this framework, we prove key regularity properties. This enable us to build a calibration technique that combines online methods with convex Tikhonov regularization tools. Such procedure is used to solve the inverse problem of local volatility identification. As a result, we prove convergence rates with respect to noise and a corresponding discrepancy-based choice for the regularization parameter. We conclude by illustrating the theoretical results by means of numerical tests.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn existence of a variational regularization parameter under Morozov's discrepancy principle

Wei Wang, Liang Ding, Long Li et al.

Calibration of Local Volatility Models with Stochastic Interest Rates using Optimal Transport

Gregoire Loeper, Jan Obloj, Benjamin Joseph

| Title | Authors | Year | Actions |

|---|

Comments (0)