Summary

We introduce a local volatility model for the valuation of options on commodity futures by using European vanilla option prices. The corresponding calibration problem is addressed within an online framework, allowing the use of multiple price surfaces. Since uncertainty in the observation of the underlying future prices translates to uncertainty in data locations, we propose a model-based adjustment of such prices that improves reconstructions and smile adherence. In order to tackle the ill-posedness of the calibration problem we incorporate a priori information through a judiciously designed Tikhonov-type regularization. Extensive empirical tests with market as well as synthetic data are used to demonstrate the effectiveness of the methodology and algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

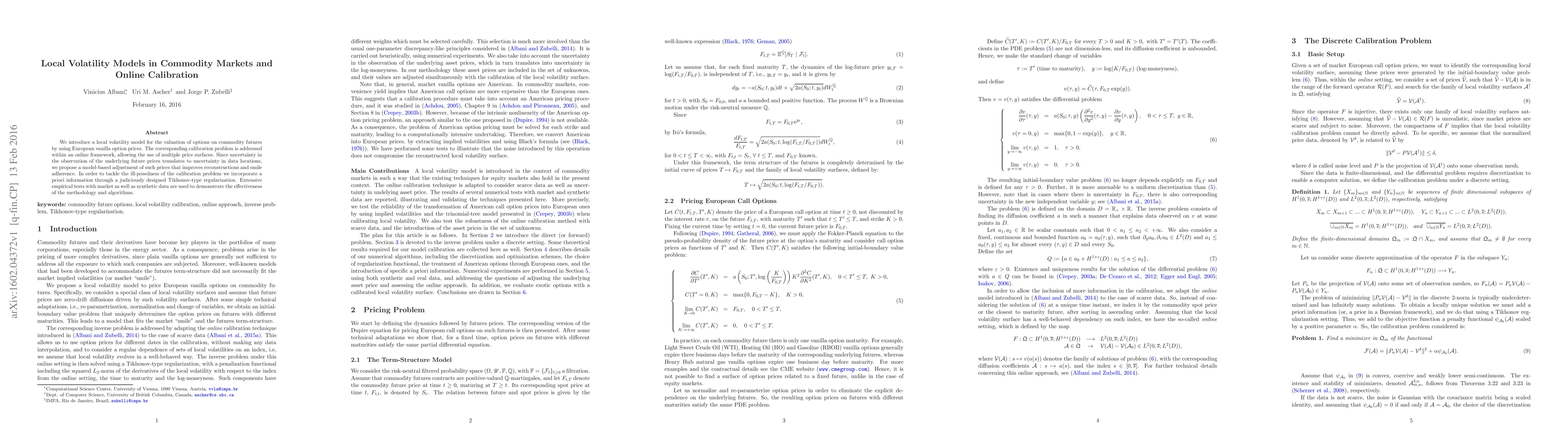

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Variable Volatility Elasticity Model from Commodity Markets

Ting Wang, Fuzhou Gong

| Title | Authors | Year | Actions |

|---|

Comments (0)