Summary

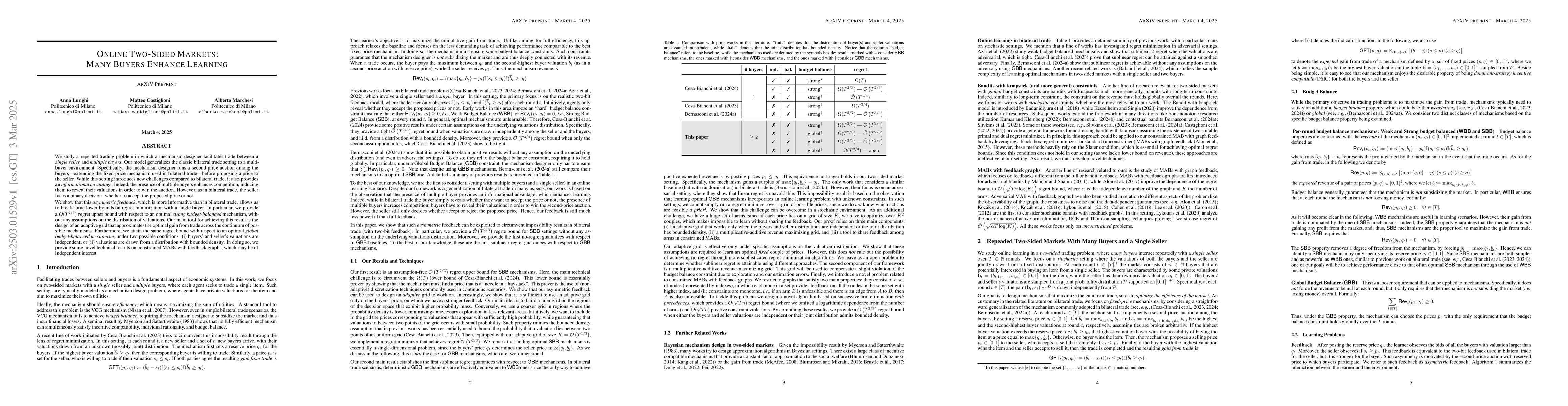

We study a repeated trading problem in which a mechanism designer facilitates trade between a single seller and multiple buyers. Our model generalizes the classic bilateral trade setting to a multi-buyer environment. Specifically, the mechanism designer runs a second-price auction among the buyers -- extending the fixed-price mechanism used in bilateral trade -- before proposing a price to the seller. While this setting introduces new challenges compared to bilateral trade, it also provides an informational advantage. Indeed, the presence of multiple buyers enhances competition, inducing them to reveal their valuations in order to win the auction. However, as in bilateral trade, the seller faces a binary decision: whether to accept the proposed price or not. We show that this asymmetric feedback, which is more informative than in bilateral trade, allows us to break some lower bounds on regret minimization with a single buyer. In particular, we provide a $\tilde O(T^{2/3})$ regret upper bound with respect to an optimal strong budget-balanced mechanism, without any assumptions on the distribution of valuations. Our main tool for achieving this result is the design of an adaptive grid that approximates the optimal gain from trade across the continuum of possible mechanisms. Furthermore, we attain the same regret bound with respect to an optimal global budget-balanced mechanism, under two possible conditions: (i) buyers' and seller's valuations are independent, or (ii) valuations are drawn from a distribution with bounded density. In doing so, we provide some novel technical results on constrained MABs with feedback graphs, which may be of independent interest.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a second-price auction mechanism in a multi-buyer environment, extending the fixed-price mechanism of bilateral trade, to facilitate learning about buyer valuations.

Key Results

- The mechanism designer achieves a regret upper bound of $ ilde O(T^{2/3})$ with respect to an optimal strong budget-balanced mechanism, without assumptions on valuation distribution.

- This result extends beyond single-buyer settings, breaking lower bounds on regret minimization.

- The paper also attains the same regret bound with respect to an optimal global budget-balanced mechanism under independent buyer and seller valuations or when valuations are drawn from a distribution with bounded density.

Significance

This work is significant as it enhances the understanding of online two-sided markets, providing a method to leverage competition among multiple buyers to reveal their valuations, which improves the seller's decision-making process.

Technical Contribution

The paper introduces an adaptive grid mechanism to approximate the optimal gain from trade across a continuum of possible mechanisms, facilitating regret minimization in complex, multi-buyer environments.

Novelty

The approach of using an adaptive grid to approximate optimal mechanisms in a multi-buyer setting with asymmetric feedback is novel, extending prior work on bilateral trade to more complex market dynamics.

Limitations

- The study assumes a specific auction format (second-price auction) and does not explore the impact of alternative mechanisms.

- The analysis focuses on regret minimization and does not delve into other performance metrics like social welfare.

Future Work

- Investigate the performance of different auction formats in multi-buyer settings.

- Explore the trade-offs between regret minimization and other market performance metrics.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Power of Two-sided Recruitment in Two-sided Markets

Aranyak Mehta, Christopher Liaw, Yang Cai et al.

No citations found for this paper.

Comments (0)