Authors

Summary

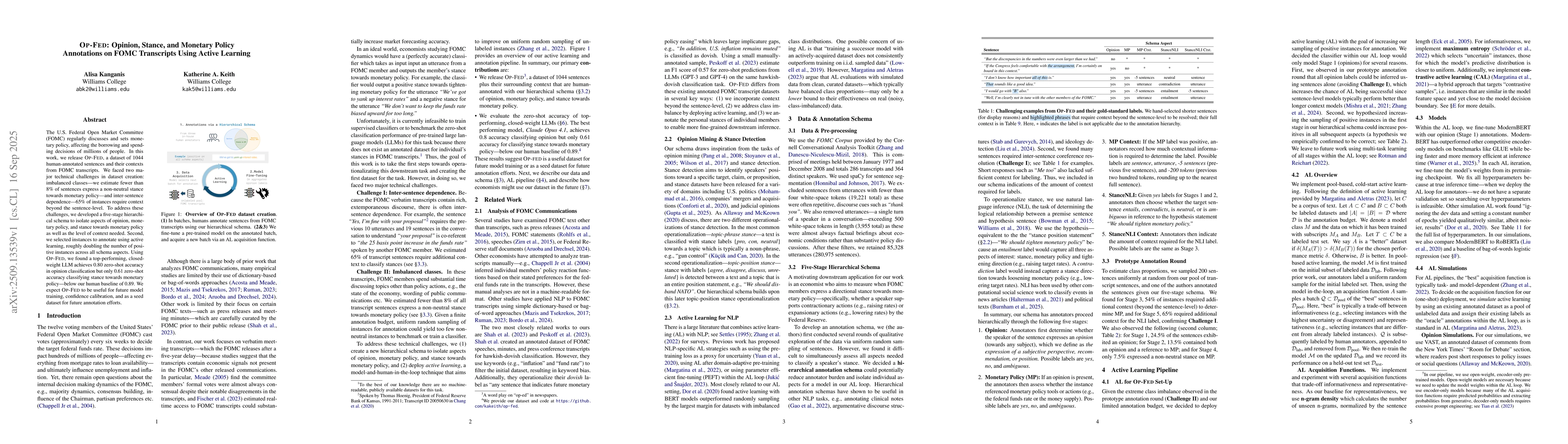

The U.S. Federal Open Market Committee (FOMC) regularly discusses and sets monetary policy, affecting the borrowing and spending decisions of millions of people. In this work, we release Op-Fed, a dataset of 1044 human-annotated sentences and their contexts from FOMC transcripts. We faced two major technical challenges in dataset creation: imbalanced classes -- we estimate fewer than 8% of sentences express a non-neutral stance towards monetary policy -- and inter-sentence dependence -- 65% of instances require context beyond the sentence-level. To address these challenges, we developed a five-stage hierarchical schema to isolate aspects of opinion, monetary policy, and stance towards monetary policy as well as the level of context needed. Second, we selected instances to annotate using active learning, roughly doubling the number of positive instances across all schema aspects. Using Op-Fed, we found a top-performing, closed-weight LLM achieves 0.80 zero-shot accuracy in opinion classification but only 0.61 zero-shot accuracy classifying stance towards monetary policy -- below our human baseline of 0.89. We expect Op-Fed to be useful for future model training, confidence calibration, and as a seed dataset for future annotation efforts.

AI Key Findings

Generated Sep 22, 2025

Methodology

The research employs an active learning framework combined with contrastive active learning (CAL) to iteratively select the most informative samples for labeling. It evaluates different acquisition functions such as n-gram density, maximum entropy, and CAL, using datasets like VAST+AN and TDW+AN to simulate real-world scenarios.

Key Results

- The maximum entropy acquisition function outperformed others in one-shot deployment, showing a steeper acquisition curve.

- Using CAL improved the balance between informativeness and representativeness in sample selection.

- The study demonstrated that class imbalance significantly affects model performance, with better results under 25%-75% positive-neutral distribution.

Significance

This research advances active learning techniques by providing a robust framework for selecting informative samples, which can improve model efficiency and reduce labeling costs in real-world applications involving domain-specific data like Federal Reserve communications.

Technical Contribution

The work introduces a hybrid contrastive active learning approach that combines informativeness and representativeness, along with a novel method for computing divergence scores using Kullback–Leibler divergence between predicted class distributions.

Novelty

This research introduces a novel contrastive active learning strategy that addresses limitations of traditional acquisition functions by combining both informativeness and representativeness, making it more effective for domain-specific tasks like analyzing Federal Reserve communications.

Limitations

- The experiments are limited to specific datasets related to Federal Reserve communications, which may not generalize to other domains.

- The study focuses on binary classification tasks, limiting its applicability to multi-class scenarios.

Future Work

- Exploring alternative hyperparameters in CAL, such as different values for k and distance metrics.

- Investigating the integration of manual inspection for more nuanced semantic similarity judgments.

- Extending the framework to multi-class classification tasks and other domains beyond Federal Reserve communications.

Paper Details

PDF Preview

Similar Papers

Found 4 papersExamining the Effect of Monetary Policy and Monetary Policy Uncertainty on Cryptocurrencies Market

Mohammadreza Mahmoudi

Monetary Policy, Digital Assets, and DeFi Activity

Leandros Tassiulas, Georgios Palaiokrassas, Iason Ofeidis et al.

Comments (0)