Summary

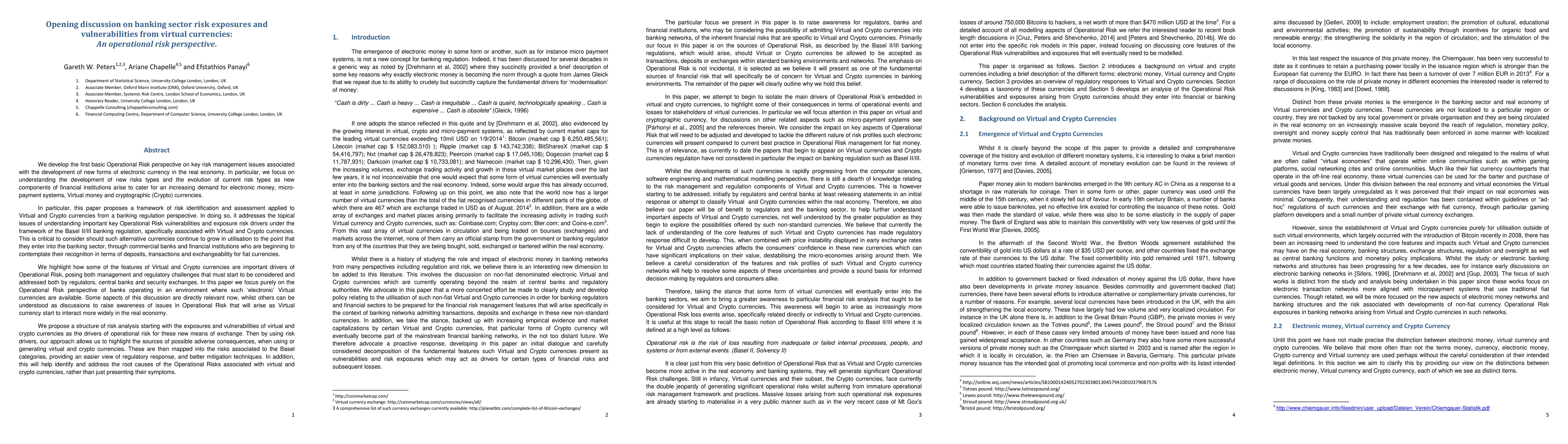

We develop the first basic Operational Risk perspective on key risk management issues associated with the development of new forms of electronic currency in the real economy. In particular, we focus on understanding the development of new risks types and the evolution of current risk types as new components of financial institutions arise to cater for an increasing demand for electronic money, micro-payment systems, Virtual money and cryptographic (Crypto) currencies. In particular, this paper proposes a framework of risk identification and assessment applied to Virtual and Crypto currencies from a banking regulation perspective. In doing so, it addresses the topical issues of understanding important key Operational Risk vulnerabilities and exposure risk drivers under the framework of the Basel II/III banking regulation, specifically associated with Virtual and Crypto currencies. This is critical to consider should such alternative currencies continue to grow in utilisation to the point that they enter into the banking sector, through commercial banks and financial institutions who are beginning to contemplate their recognition in terms of deposits, transactions and exchangeability for fiat currencies. We highlight how some of the features of Virtual and Crypto currencies are important drivers of Operational Risk, posing both management and regulatory challenges that must start to be considered and addressed both by regulators, central banks and security exchanges. In this paper we focus purely on the Operational Risk perspective of banks operating in an environment where such electronic Virtual currencies are available. Some aspects of this discussion are directly relevant now, whilst others can be understood as discussions to raise awareness of issues in Operational Risk that will arise as Virtual currency start to interact more widely in the real economy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalysing the Influence of Macroeconomic Factors on Credit Risk in the UK Banking Sector

Bayode Ogunleye, Oluwaseun Ajao, Hemlata Sharma et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)