Summary

We study an asset allocation stochastic problem with restriction for a defined-contribution pension plan during the accumulation phase. We consider a financial market with stochastic interest rate, composed of a risk-free asset, a real zero coupon bond price, the inflation-linked bond and the risky asset. A plan member aims to maximize the expected power utility derived from the terminal wealth. In order to protect the rights of a member who dies before retirement, we introduce a clause which allows to withdraw his premiums and the difference is distributed among the survival members. Besides the mortality risk, the fund manager takes into account the salary and the inflation risks. We then obtain closed form solutions for the asset allocation problem using a sufficient maximum principle approach for the problem with partial information. Finally, we give a numerical example.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

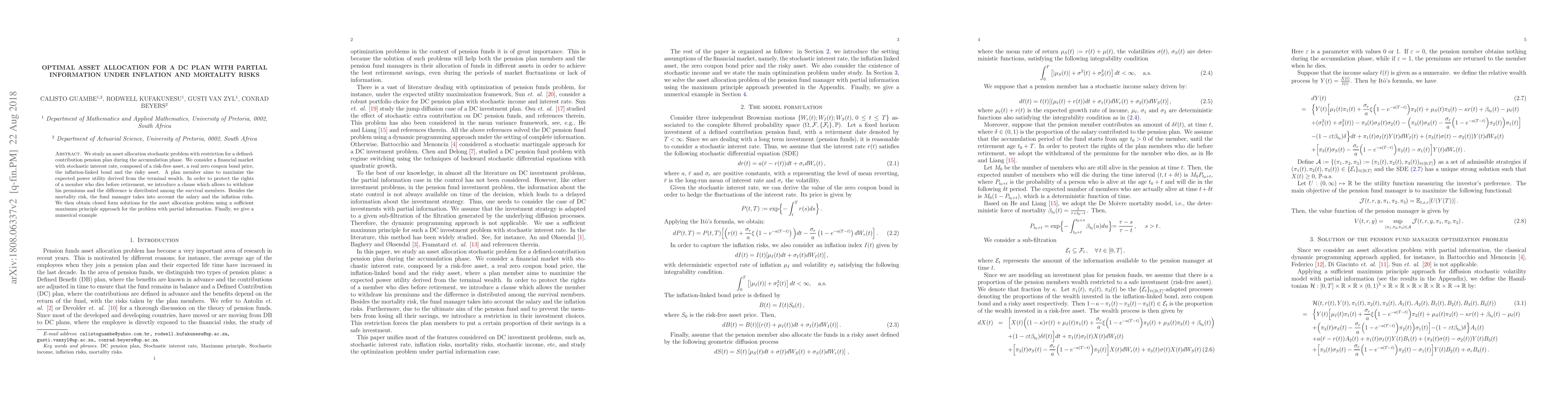

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)