Summary

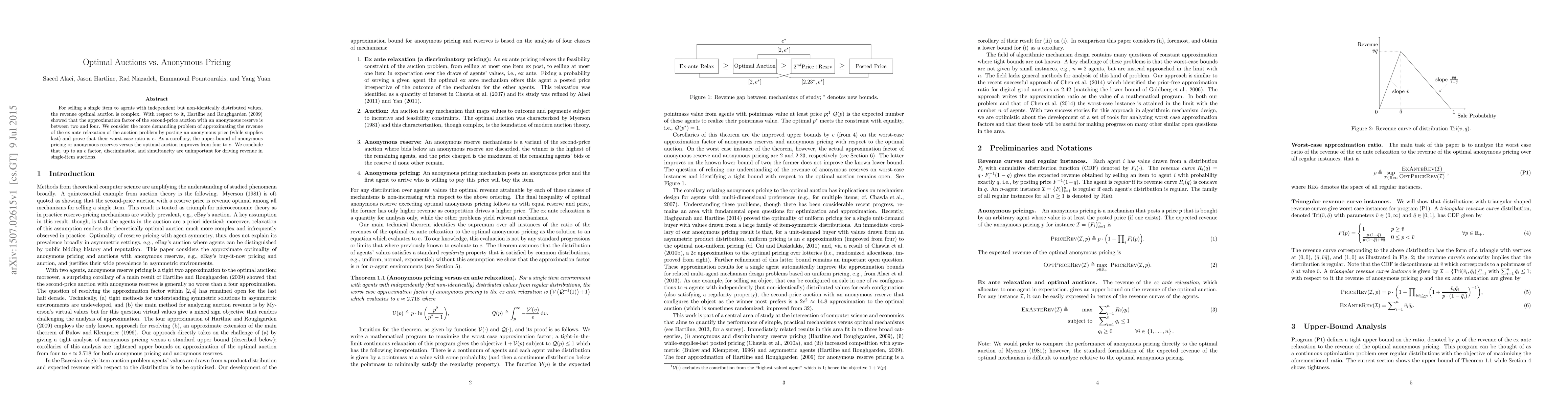

For selling a single item to agents with independent but non-identically distributed values, the revenue optimal auction is complex. With respect to it, Hartline and Roughgarden (2009) showed that the approximation factor of the second-price auction with an anonymous reserve is between two and four. We consider the more demanding problem of approximating the revenue of the ex ante relaxation of the auction problem by posting an anonymous price (while supplies last) and prove that their worst-case ratio is e. As a corollary, the upper-bound of anonymous pricing or anonymous reserves versus the optimal auction improves from four to $e$. We conclude that, up to an $e$ factor, discrimination and simultaneity are unimportant for driving revenue in single-item auctions.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper uses mathematical analysis and relaxation techniques to compare the revenue of optimal auctions with that of anonymous pricing mechanisms.

Key Results

- The worst-case approximation factor of the second-price auction with an anonymous reserve is shown to be between two and four.

- It is proven that the upper-bound of anonymous pricing or anonymous reserves versus the optimal auction improves from four to $e$.

- The paper concludes that, up to an $e$ factor, discrimination and simultaneity are unimportant for driving revenue in single-item auctions.

Significance

This research provides insights into the efficiency of different auction formats, helping to inform the design of practical auction mechanisms in various economic and market settings.

Technical Contribution

The paper presents a formal proof of the approximation ratio for anonymous pricing mechanisms and establishes a lower bound for the revenue of optimal auctions, thereby advancing the theoretical understanding of auction theory.

Novelty

The work introduces a novel approach to bounding the revenue of anonymous pricing mechanisms and provides a more precise characterization of the gap between optimal auctions and simpler, non-discriminatory pricing methods.

Limitations

- The analysis focuses on single-item auctions and may not directly generalize to multi-item settings.

- The theoretical results are derived under specific conditions and assumptions about agent valuations.

Future Work

- Further exploration into the implications of these findings for more complex auction environments, such as multi-item auctions or auctions with budget constraints.

- Investigating how these results extend to settings with correlated valuations or risk-averse agents.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEquitable Pricing in Auctions

Bary Pradelski, Patrick Loiseau, Simon Mauras et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)