Summary

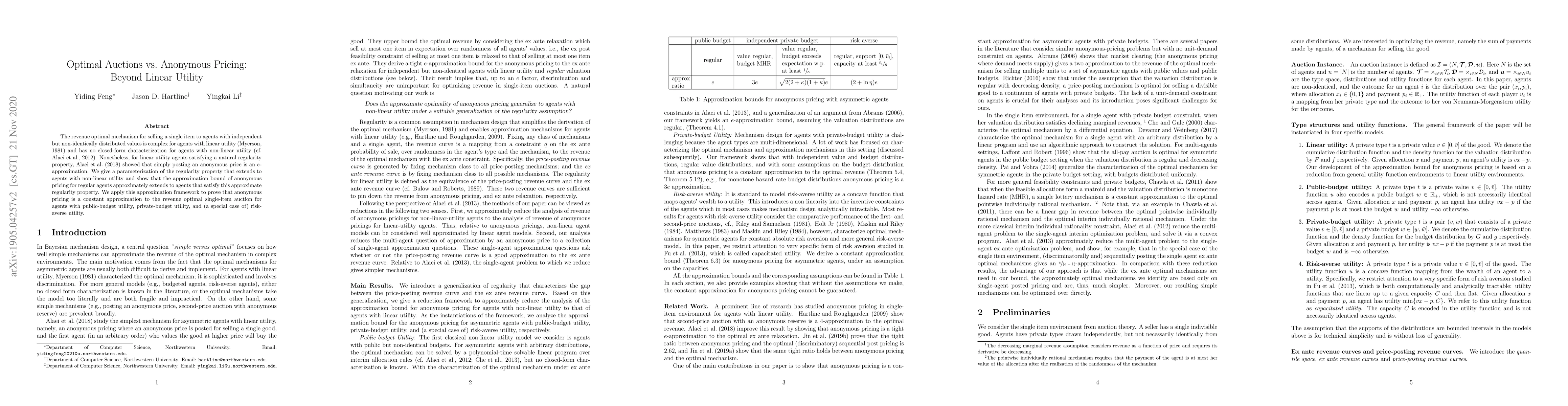

The revenue optimal mechanism for selling a single item to agents with independent but non-identically distributed values is complex for agents with linear utility (Myerson,1981) and has no closed-form characterization for agents with non-linear utility (cf. Alaei et al., 2012). Nonetheless, for linear utility agents satisfying a natural regularity property, Alaei et al. (2018) showed that simply posting an anonymous price is an e-approximation. We give a parameterization of the regularity property that extends to agents with non-linear utility and show that the approximation bound of anonymous pricing for regular agents approximately extends to agents that satisfy this approximate regularity property. We apply this approximation framework to prove that anonymous pricing is a constant approximation to the revenue optimal single-item auction for agents with public-budget utility, private-budget utility, and (a special case of) risk-averse utility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEquitable Pricing in Auctions

Bary Pradelski, Patrick Loiseau, Simon Mauras et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)