Summary

This paper examines a Markovian model for the optimal irreversible investment problem of a firm aiming at minimizing total expected costs of production. We model market uncertainty and the cost of investment per unit of production capacity as two independent one-dimensional regular diffusions, and we consider a general convex running cost function. The optimization problem is set as a three-dimensional degenerate singular stochastic control problem. We provide the optimal control as the solution of a Skorohod reflection problem at a suitable boundary surface. Such boundary arises from the analysis of a family of two-dimensional parameter-dependent optimal stopping problems and it is characterized in terms of the family of unique continuous solutions to parameter-dependent nonlinear integral equations of Fredholm type.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

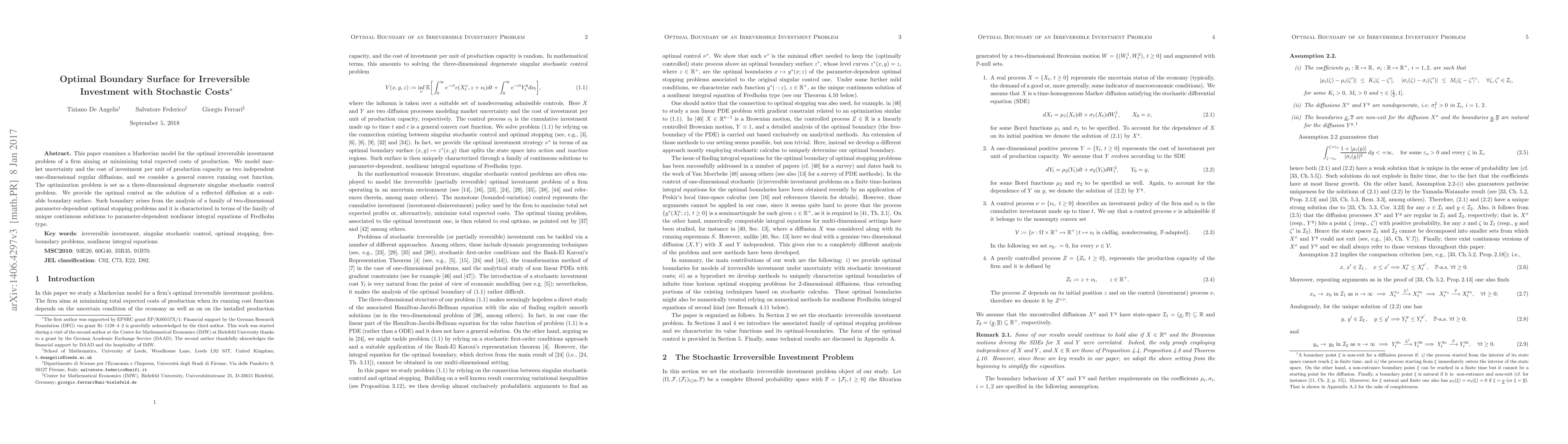

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)