Summary

A problem of optimally purchasing electricity at a real-valued spot price (that is, with potentially negative cost) has been recently addressed in De Angelis, Ferrari and Moriarty (2015) [SIAM J. Control Optim. 53(3)]. This problem can be considered one of irreversible investment with a cost functional which is non convex with respect to the control variable. In this paper we study the optimal entry into this investment plan. The optimal entry policy can have an irregular boundary arising from this non convexity, with a kinked shape.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

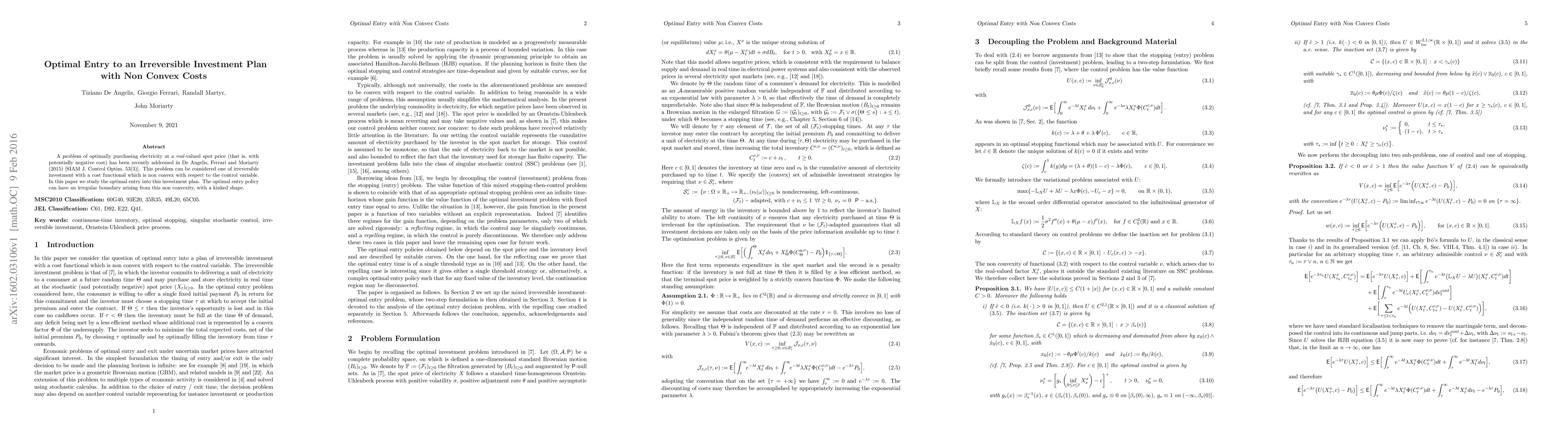

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)