Authors

Summary

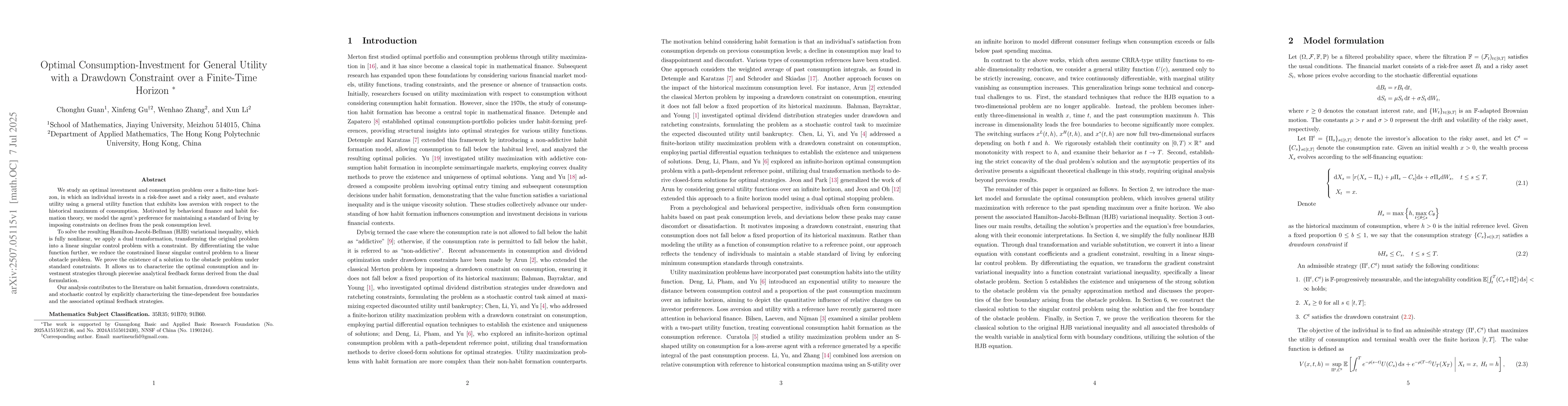

We study an optimal investment and consumption problem over a finite-time horizon, in which an individual invests in a risk-free asset and a risky asset, and evaluate utility using a general utility function that exhibits loss aversion with respect to the historical maximum of consumption. Motivated by behavioral finance and habit formation theory, we model the agent's preference for maintaining a standard of living by imposing constraints on declines from the peak consumption level. To solve the resulting Hamilton-Jacobi-Bellman (HJB) variational inequality, which is fully nonlinear, we apply a dual transformation, transforming the original problem into a linear singular control problem with a constraint. By differentiating the value function further, we reduce the constrained linear singular control problem to a linear obstacle problem. We prove the existence of a solution to the obstacle problem under standard constraints. It allows us to characterize the optimal consumption and investment strategies through piecewise analytical feedback forms derived from the dual formulation. Our analysis contributes to the literature on habit formation, drawdown constraints, and stochastic control by explicitly characterizing the time-dependent free boundaries and the associated optimal feedback strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal consumption under a drawdown constraint over a finite horizon

Xiang Yu, Xun Li, Xiaoshan Chen et al.

An Optimal Consumption-Investment Model with Constraint on Consumption

Zuo Quan Xu, Fahuai Yi

Optimal consumption under relaxed benchmark tracking and consumption drawdown constraint

Xiang Yu, Lijun Bo, Yijie Huang et al.

No citations found for this paper.

Comments (0)