Summary

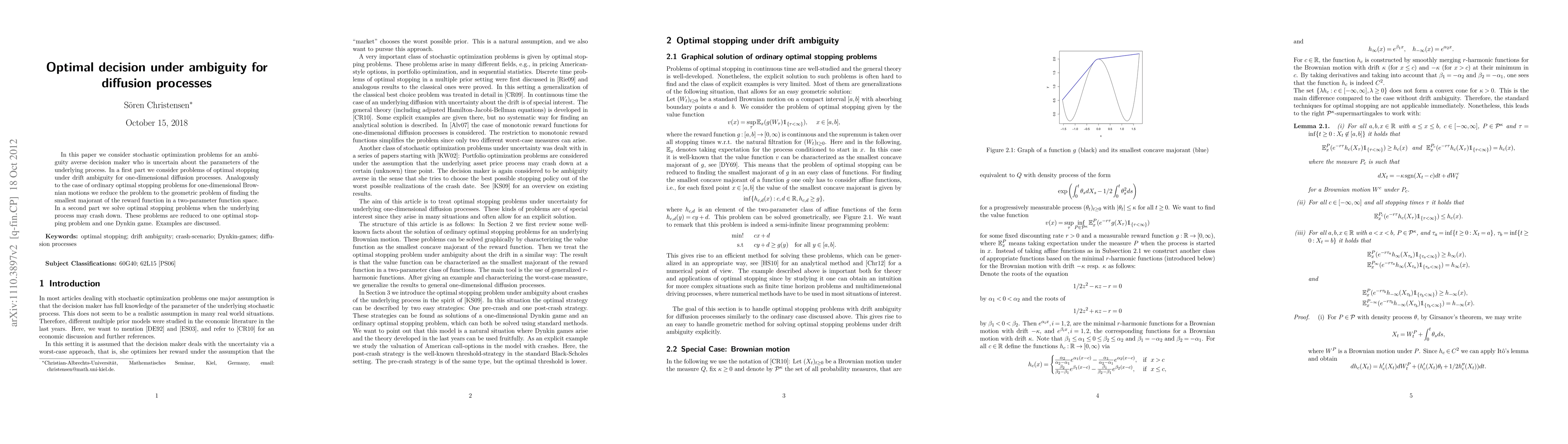

In this paper we consider stochastic optimization problems for an ambiguity averse decision maker who is uncertain about the parameters of the underlying process. In a first part we consider problems of optimal stopping under drift ambiguity for one-dimensional diffusion processes. Analogously to the case of ordinary optimal stopping problems for one-dimensional Brownian motions we reduce the problem to the geometric problem of finding the smallest majorant of the reward function in a two-parameter function space. In a second part we solve optimal stopping problems when the underlying process may crash down. These problems are reduced to one optimal stopping problem and one Dynkin game. Examples are discussed.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)