Authors

Summary

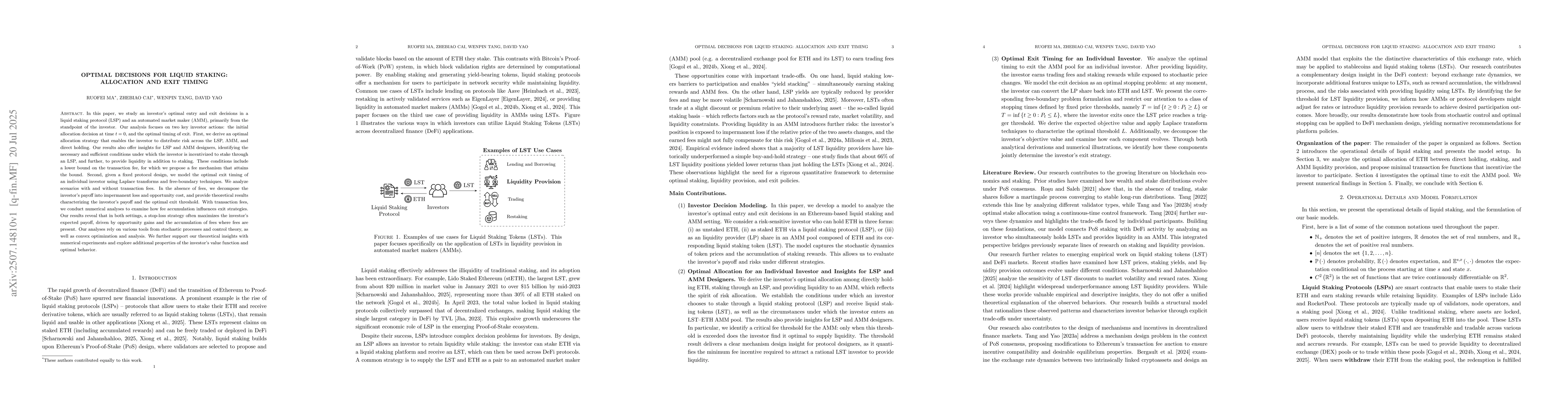

In this paper, we study an investor's optimal entry and exit decisions in a liquid staking protocol (LSP) and an automated market maker (AMM), primarily from the standpoint of the investor. Our analysis focuses on two key investor actions: the initial allocation decision at time t=0, and the optimal timing of exit. First, we derive an optimal allocation strategy that enables the investor to distribute risk across the LSP, AMM, and direct holding. Our results also offer insights for LSP and AMM designers, identifying the necessary and sufficient conditions under which the investor is incentivized to stake through an LSP, and further, to provide liquidity in addition to staking. These conditions include a lower bound on the transaction fee, for which we propose a fee mechanism that attains the bound. Second, given a fixed protocol design, we model the optimal exit timing of an individual investor using Laplace transforms and free-boundary techniques. We analyze scenarios with and without transaction fees. In the absence of fees, we decompose the investor's payoff into impermanent loss and opportunity cost, and provide theoretical results characterizing the investor's payoff and the optimal exit threshold. With transaction fees, we conduct numerical analyses to examine how fee accumulation influences exit strategies. Our results reveal that in both settings, a stop-loss strategy often maximizes the investor's expected payoff, driven by opportunity gains and the accumulation of fees where fees are present. Our analyses rely on various tools from stochastic processes and control theory, as well as convex optimization and analysis. We further support our theoretical insights with numerical experiments and explore additional properties of the investor's value function and optimal behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoK: Liquid Staking Tokens (LSTs)

Krzysztof Gogol, Claudio Tessone, Benjamin Kraner et al.

Leverage Staking with Liquid Staking Derivatives (LSDs): Opportunities and Risks

Xi Chen, Xihan Xiong, Zhipeng Wang et al.

Empirical and Theoretical Analysis of Liquid Staking Protocols

Burkhard Stiller, Krzysztof Gogol, Claudio Tessone et al.

Liquid Staking Tokens in Automated Market Makers

Krzysztof Gogol, Johnnatan Messias, Claudio Tessone et al.

No citations found for this paper.

Comments (0)