Summary

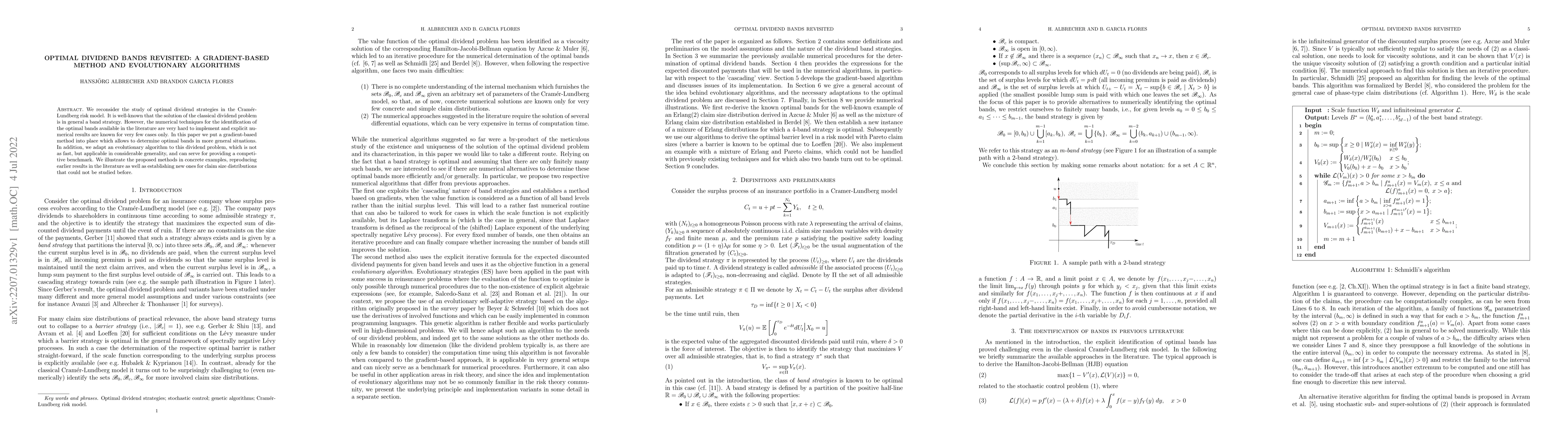

We reconsider the study of optimal dividend strategies in the Cram\'er-Lundberg risk model. It is well-known that the solution of the classical dividend problem is in general a band strategy. However, the numerical techniques for the identification of the optimal bands available in the literature are very hard to implement and explicit numerical results are known for very few cases only. In this paper we put a gradient-based method into place which allows to determine optimal bands in more general situations. In addition, we adapt an evolutionary algorithm to this dividend problem, which is not as fast, but applicable in considerable generality, and can serve for providing a competitive benchmark. We illustrate the proposed methods in concrete examples, reproducing earlier results in the literature as well as establishing new ones for claim size distributions that could not be studied before.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)