Summary

Trading algorithms that execute large orders are susceptible to exploitation by order anticipation strategies. This paper studies the influence of order anticipation strategies in a multi-investor model of optimal execution under transient price impact. Existence and uniqueness of a Nash equilibrium is established under the assumption that trading incurs quadratic transaction costs. A closed-form representation of the Nash equilibrium is derived for exponential decay kernels. With this representation, it is shown that while order anticipation strategies raise the execution costs of a large order significantly, they typically do not cause price overshooting in the sense of Brunnermeier and Pedersen.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

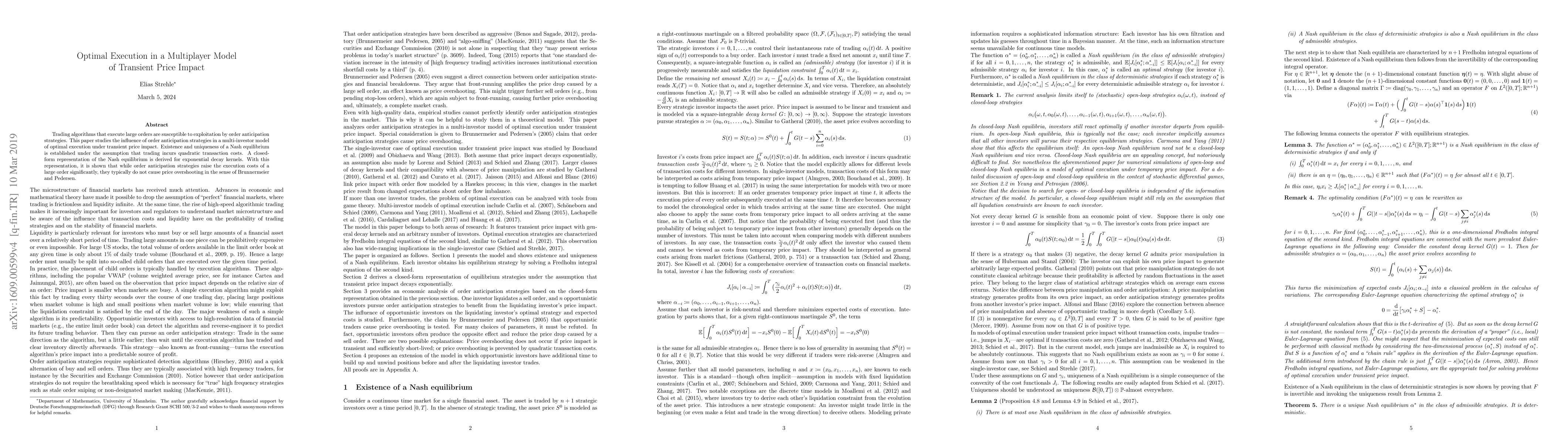

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Execution among $N$ Traders with Transient Price Impact

Marcel Nutz, Steven Campbell

Optimal order execution under price impact: A hybrid model

Tai-Ho Wang, Marina Di Giacinto, Claudio Tebaldi

| Title | Authors | Year | Actions |

|---|

Comments (0)