Authors

Summary

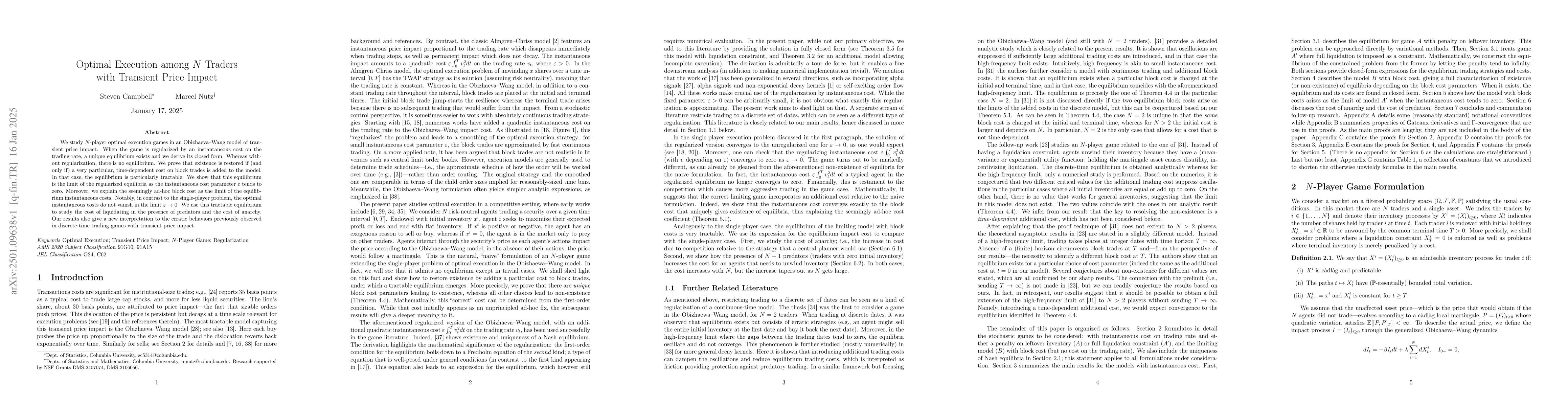

We study $N$-player optimal execution games in an Obizhaeva--Wang model of transient price impact. When the game is regularized by an instantaneous cost on the trading rate, a unique equilibrium exists and we derive its closed form. Whereas without regularization, there is no equilibrium. We prove that existence is restored if (and only if) a very particular, time-dependent cost on block trades is added to the model. In that case, the equilibrium is particularly tractable. We show that this equilibrium is the limit of the regularized equilibria as the instantaneous cost parameter $\varepsilon$ tends to zero. Moreover, we explain the seemingly ad-hoc block cost as the limit of the equilibrium instantaneous costs. Notably, in contrast to the single-player problem, the optimal instantaneous costs do not vanish in the limit $\varepsilon\to0$. We use this tractable equilibrium to study the cost of liquidating in the presence of predators and the cost of anarchy. Our results also give a new interpretation to the erratic behaviors previously observed in discrete-time trading games with transient price impact.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersOptimal Signal-Adaptive Trading with Temporary and Transient Price Impact

Eyal Neuman, Moritz Voß

| Title | Authors | Year | Actions |

|---|

Comments (0)