Authors

Summary

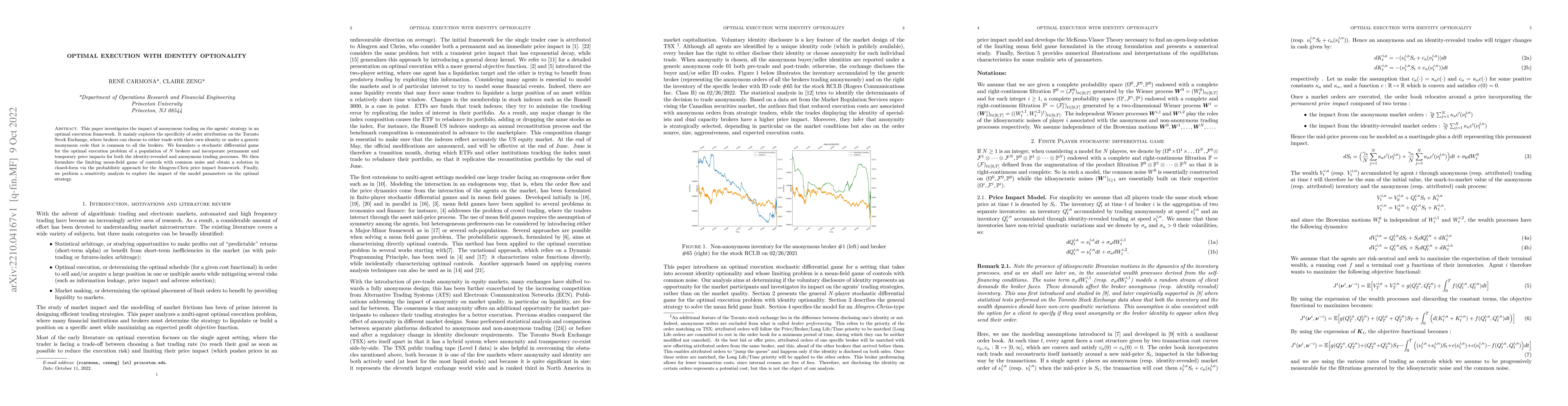

This paper investigates the impact of anonymous trading on the agents' strategy in an optimal execution framework. It mainly explores the specificity of order attribution on the Toronto Stock Exchange, where brokers can choose to either trade with their own identity or under a generic anonymous code that is common to all the brokers. We formulate a stochastic differential game for the optimal execution problem of a population of $N$ brokers and incorporate permanent and temporary price impacts for both the identity-revealed and anonymous trading processes. We then formulate the limiting mean-field game of controls with common noise and obtain a solution in closed-form via the probabilistic approach for the Almgren-Chris price impact framework. Finally, we perform a sensitivity analysis to explore the impact of the model parameters on the optimal strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)