Authors

Summary

We expose a theoretical hedging optimization framework with variational preferences under convex risk measures. We explore a general dual representation for the composition between risk measures and utilities. We study the properties of the optimization problem as a convex and monotone map per se. We also derive results for optimality and indifference pricing conditions. We also explore particular examples inside our setup.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

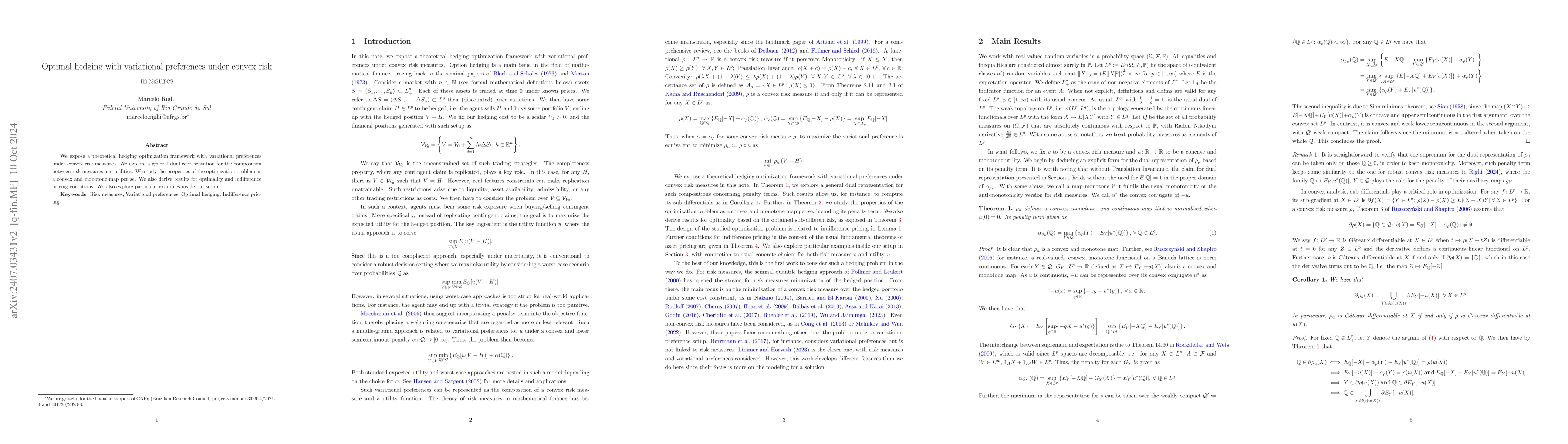

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)