Summary

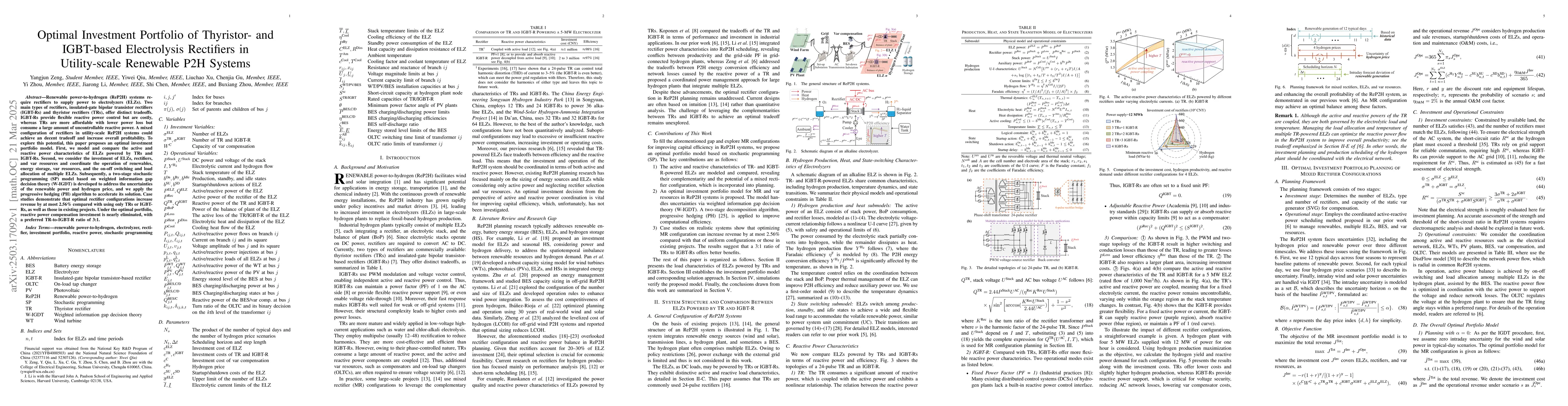

Renewable power-to-hydrogen (ReP2H) systems require rectifiers to supply power to electrolyzers (ELZs). Two main types of rectifiers, insulated-gate bipolar transistor rectifiers (IGBT-Rs) and thyristor rectifiers (TRs), offer distinct tradeoffs. IGBT-Rs provide flexible reactive power control but are costly, whereas TRs are more affordable with lower power loss but consume a large amount of uncontrollable reactive power. A mixed configuration of rectifiers in utility-scale ReP2H systems could achieve an decent tradeoff and increase overall profitability. To explore this potential, this paper proposes an optimal investment portfolio model. First, we model and compare the active and reactive power characteristics of ELZs powered by TRs and IGBT-Rs. Second, we consider the investment of ELZs, rectifiers, and var resources and coordinate the operation of renewables, energy storage, var resources, and the on-off switching and load allocation of multiple ELZs. Subsequently, a two-stage stochastic programming (SP) model based on weighted information gap decision theory (W-IGDT) is developed to address the uncertainties of the renewable power and hydrogen price, and we apply the progressive hedging (PH) algorithm to accelerate its solution. Case studies demonstrate that optimal rectifier configurations increase revenue by at most 2.56% compared with using only TRs or IGBT-Rs, as well as those in existing projects. Under the optimal portfolio, reactive power compensation investment is nearly eliminated, with a preferred TR-to-IGBT-R ratio of 3:1.

AI Key Findings

Generated Jun 10, 2025

Methodology

This research proposes an optimal investment portfolio model for mixed rectifier configurations in utility-scale renewable P2H systems, utilizing a two-stage stochastic programming (SP) model based on weighted information gap decision theory (W-IGDT) to address uncertainties in renewable power and hydrogen prices.

Key Results

- Optimal rectifier configurations increase revenue by at most 2.56% compared with using only TRs or IGBT-Rs, as well as those in existing projects.

- Under the optimal portfolio, reactive power compensation investment is nearly eliminated.

- A preferred TR-to-IGBT-R ratio of 3:1 is found to be optimal.

- The model effectively balances reactive power in the hydrogen plant, optimizes investment in SVG to approximately 0, and fully utilizes the reactive power support capability of IGBT-Rs.

Significance

This study is important for optimizing the economic efficiency and operational stability of renewable P2H systems by determining the ideal mix of thyristor and IGBT-based rectifiers, which can guide future large-scale renewable energy integration projects.

Technical Contribution

The paper introduces a novel two-stage stochastic programming model based on W-IGDT for optimizing the investment portfolio of mixed rectifier configurations in renewable P2H systems, addressing uncertainties in renewable power and hydrogen prices.

Novelty

The research distinguishes itself by integrating W-IGDT with a two-stage SP model to handle uncertainties, providing a more robust and practical solution for optimal rectifier configuration in utility-scale renewable P2H systems compared to existing models.

Limitations

- The study is limited to specific system configurations and may not be universally applicable without adjustments for different system sizes and characteristics.

- The model's performance heavily relies on the accuracy of input parameters and assumptions regarding renewable power generation and hydrogen prices.

Future Work

- Further research could explore the dynamic behavior and performance of different electrolysis rectifiers under varying operational conditions.

- Investigating the impact of transient conditions and weak grid scenarios on the performance of mixed rectifier configurations.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtended Load Flexibility of Utility-Scale P2H Plants: Optimal Production Scheduling Considering Dynamic Thermal and HTO Impurity Effects

Shi Chen, Yi Zhou, Jin Lin et al.

ChatGPT-based Investment Portfolio Selection

Oleksandr Romanko, Akhilesh Narayan, Roy H. Kwon

No citations found for this paper.

Comments (0)