Summary

We study the maximization of the logarithmic utility of an insider with different anticipating techniques. Our aim is to compare the usage of the forward and Skorokhod integrals in this context with multiple assets. We show theoretically and with simulations that the Skorokhod insider always overcomes the forward insider, just the opposite of what happens in the case of risk-neutral traders. Moreover, an ordinary trader might overcome both insiders if there is a large enough negative fluctuation in the driving stochastic process that leads to a negative enough final value. Our results point to the fact that the interplay between anticipating stochastic calculus and nonlinear utilities might yield non-intuitive results from the financial viewpoint.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

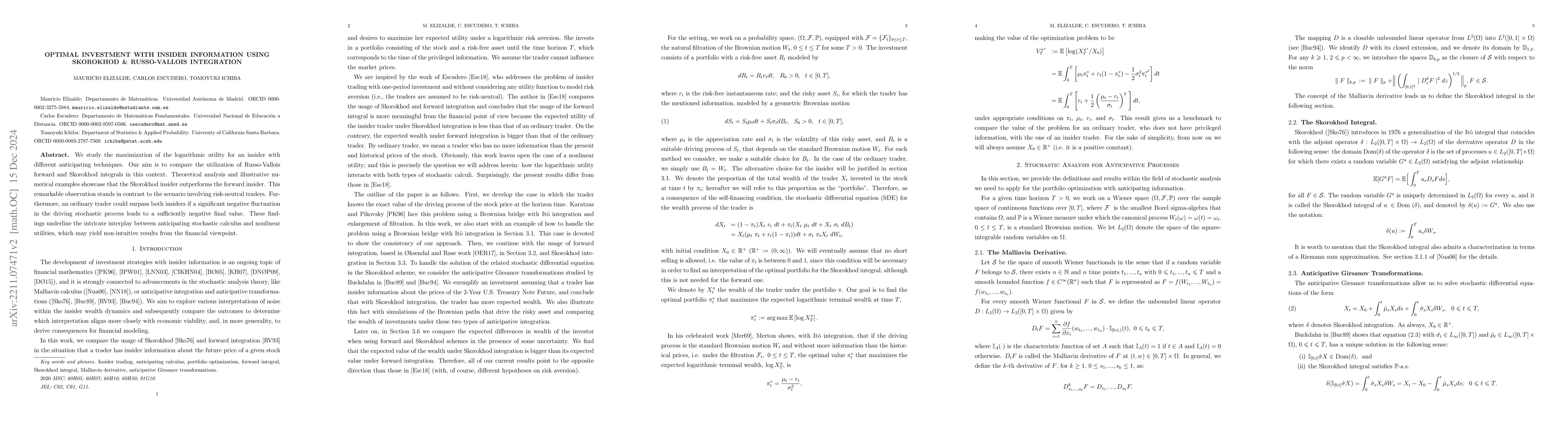

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)