Summary

A small investor provides liquidity at the best bid and ask prices of a limit order market. For small spreads and frequent orders of other market participants, we explicitly determine the investor's optimal policy and welfare. In doing so, we allow for general dynamics of the mid price, the spread, and the order flow, as well as for arbitrary preferences of the liquidity provider under consideration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

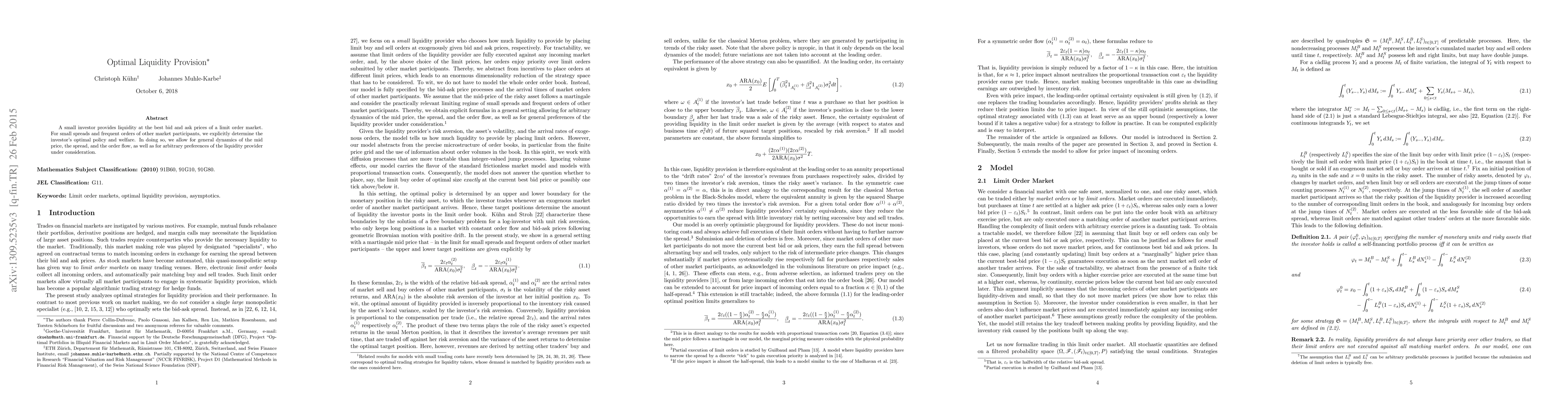

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDecentralised Finance and Automated Market Making: Predictable Loss and Optimal Liquidity Provision

Álvaro Cartea, Fayçal Drissi, Marcello Monga

Liquidity provision of utility indifference type in decentralized exchanges

Masaaki Fukasawa, Basile Maire, Marcus Wunsch

Strategic Liquidity Provision in Uniswap v3

David C. Parkes, Zhou Fan, Michael Neuder et al.

Liquidity provision with $τ$-reset strategies: a dynamic historical liquidity approach

Andrey Urusov, Rostislav Berezovskiy, Anatoly Krestenko et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)