Authors

Summary

Constant product markets with concentrated liquidity (CL) are the most popular type of automated market makers. In this paper, we characterise the continuous-time wealth dynamics of strategic LPs who dynamically adjust their range of liquidity provision in CL pools. Their wealth results from fee income, the value of their holdings in the pool, and rebalancing costs. Next, we derive a self-financing and closed-form optimal liquidity provision strategy where the width of the LP's liquidity range is determined by the profitability of the pool (provision fees minus gas fees), the predictable losses (PL) of the LP's position, and concentration risk. Concentration risk refers to the decrease in fee revenue if the marginal exchange rate (akin to the midprice in a limit order book) in the pool exits the LP's range of liquidity. When the drift in the marginal rate is stochastic, we show how to optimally skew the range of liquidity to increase fee revenue and profit from the expected changes in the marginal rate. Finally, we use Uniswap v3 data to show that, on average, LPs have traded at a significant loss, and to show that the out-of-sample performance of our strategy is superior to the historical performance of LPs in the pool we consider.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

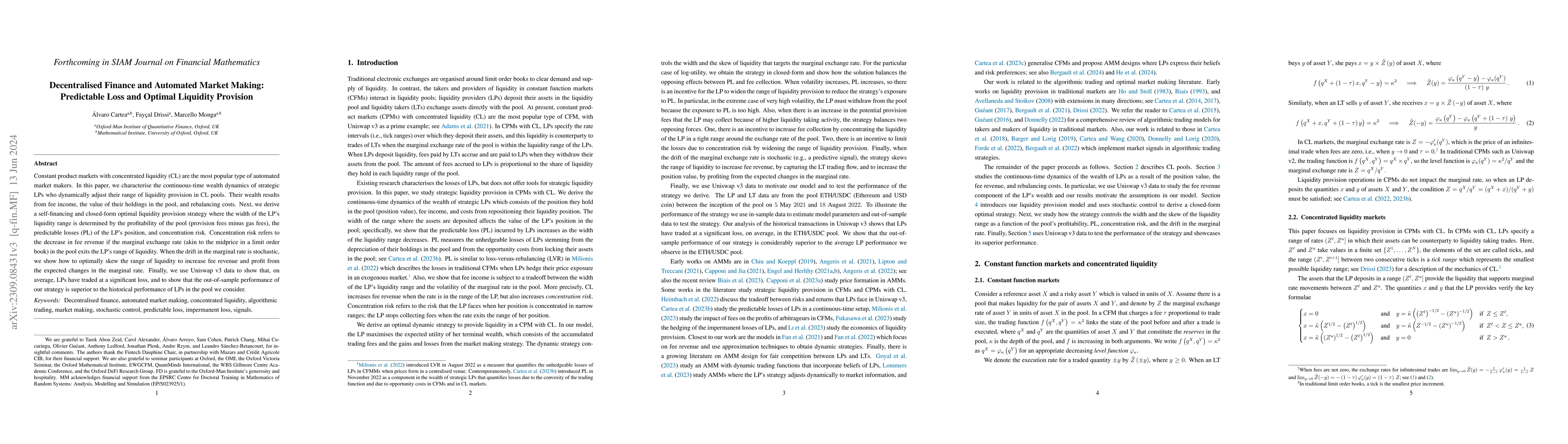

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDecentralised Finance and Automated Market Making: Execution and Speculation

Álvaro Cartea, Fayçal Drissi, Marcello Monga

Static Replication of Impermanent Loss for Concentrated Liquidity Provision in Decentralised Markets

Yun Wang, Jun Deng, Hua Zong

| Title | Authors | Year | Actions |

|---|

Comments (0)