Summary

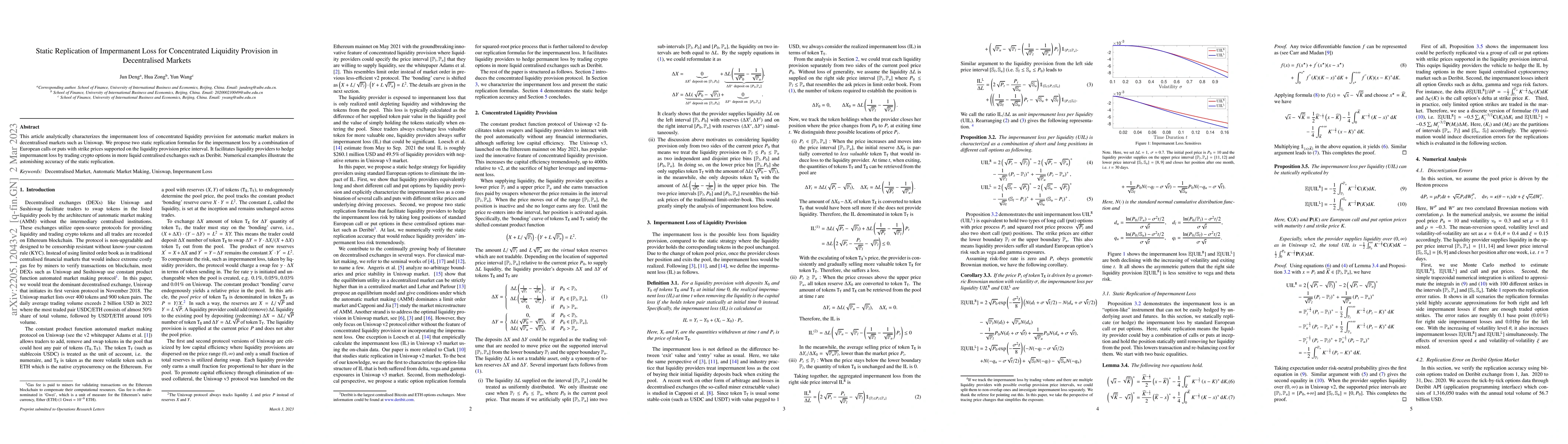

This article analytically characterizes the impermanent loss of concentrated liquidity provision for automatic market makers in decentralised markets such as Uniswap. We propose two static replication formulas for the impermanent loss by a combination of European calls or puts with strike prices supported on the liquidity provision price interval. It facilitates liquidity providers to hedge permanent loss by trading crypto options in more liquid centralised exchanges such as Deribit. Numerical examples illustrate the astonishing accuracy of the static replication.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnified Approach for Hedging Impermanent Loss of Liquidity Provision

Alexander Lipton, Vladimir Lucic, Artur Sepp

Decentralised Finance and Automated Market Making: Predictable Loss and Optimal Liquidity Provision

Álvaro Cartea, Fayçal Drissi, Marcello Monga

Pool Value Replication (CPM) and Impermanent Loss Hedging

Agustin Muñoz Gonzalez, Juan Ignacio Sequeira, Ariel Dembling

Liquidity provision of utility indifference type in decentralized exchanges

Masaaki Fukasawa, Basile Maire, Marcus Wunsch

| Title | Authors | Year | Actions |

|---|

Comments (0)