Summary

This paper investigates the optimal choices of financial derivatives to complete a financial market in the framework of stochastic volatility (SV) models. We introduce an efficient and accurate simulation-based method, applicable to generalized diffusion models, to approximate the optimal derivatives-based portfolio strategy. We build upon the double optimization approach (i.e. expected utility maximization and risk exposure minimization) proposed in Escobar-Anel et al. (2022); demonstrating that strangle options are the best choices for market completion within equity options. Furthermore, we explore the benefit of using volatility index derivatives and conclude that they could be more convenient substitutes when only long-term maturity equity options are available.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

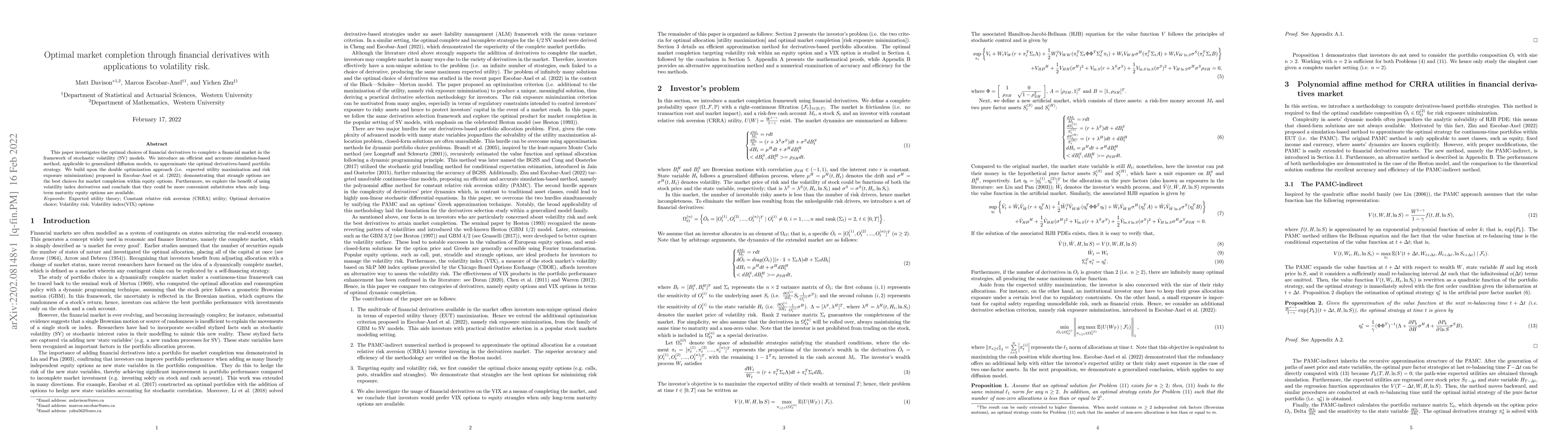

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Making and Pricing of Financial Derivatives based on Road Travel Times

Ke Wan, Alain Kornhauser

Dynamic risk measures with fluctuation of market volatility under Bochne-Lebesgue space

Fei Sun, Jieming Zhou, Jingchao Li

| Title | Authors | Year | Actions |

|---|

Comments (0)